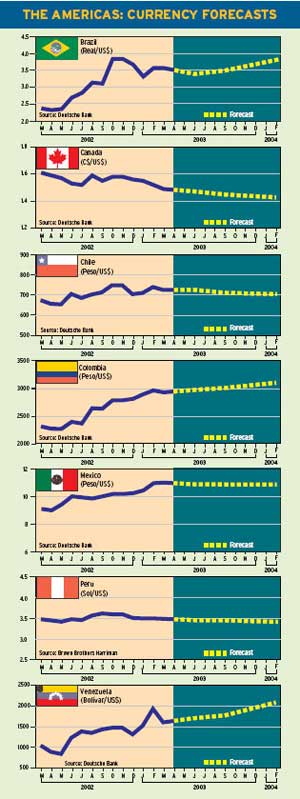

THE AMERICAS Canadian Dollar Turns Suddenly Popular

Rising interest rates, solid economic growth, a big trade surplus and strong commodity prices pro-pelled the Canadian dollar sharply higher in March.

Why did the long-hapless loonie, as the Canadian cur-rency is known, suddenly become the darling of for-eign exchange traders?

Its the difference between a glass half full and one half empty, says Stephen Poloz, chief econ-omist at Ottawa-based Export Development Canada.

The fundamentals have been screaming for a higher Canadian dollar for a long time, so long that market participants won-dered if the loonie was ever going to rise, he says.

Exchange-rate moves are a lot like earthquakes, according to Poloz.We know the fundamentals, and forecasters predict that exchange rates will react to them, yet nothing happens, sometimes for years.Then some trigger produces a sudden burst of action, he says.

Exchange rates typically overshoot their funda-mentals, he adds. Once the exchange rate begins to move, foreign exchange traders begin to place bets that it will move fur-ther; the further it moves, the further it is believed likely to move, and so on.

The rising Canadian dol-lar could pose a problem for some Canadian exporters, particularly if they have been barely eking out a profit and have been relying on the low level of the loonie to compete for business. But Poloz says most Canadian companies have been expecting a stronger cur-rency for some time.As the world economy heals, Canadas export sales increase, boosting profit margins at exporting com-panies, he says.

Canadian finance minis-ter John Manley said in early March that he was not concerned by his nations currency appreci-ation. It should be left to the markets alone to decide its appropriate level, he said.

Marc Chandler, chief cur-rency strategist at HSBC Bank USA in New York, says Canada is likely to be the fastest-growing econ-omy in the Group of 7 industrial nations in 2003. In February, as the United States was losing more than 300,000 jobs, Canada added 55,200 jobs, he notes.And the Bank of Canada is expected to raise interest rates further in the second quarter, he adds.

According to Chandler, the widening interest-rate spread between the US and Canada, especially at the short end of the yield curve, is consistent with a stronger Canadian dollar. The trajectory of the pol icy mix in Canada toward a tighter monetary policy and a looser fiscal policy is usually associated with an appreciating currency, he adds.

Mexican Peso Falls To All-Time Low

While the Canadian dollar has been rising against the US dollar in recent weeks, the Mexican peso has been falling, hitting an all-time low of 11.25 to the greenback in early March.

Mexican finance min-istry officials have sought to downplay the signifi-cance of the peso sell-off, saying it is being caused by US dollar weakness and global uncertainty. But the central bank and the finance ministry have signaled that they may support the peso by sell-ing oil dollars directly into the foreign exchange mar-ket, says Clyde Wardle, emerging market cur-rency strategist at HSBC Bank USA in New York.

According to the Mexi-can press, the selling of dollars obtained from oil exports could begin around the middle of this year, once US dollar reserves hit $55 billion. Should the peso continue to weaken aggressively, however, this timetable could be brought forward.

Wardle says the pesos decline has closely fol-lowed the dollars decline against the euro.If our year-end 2003 forecast that the euro will rise to 1.20 to the US dollar proves correct, this would imply a peso rate of around 12.20 to the dollar, assuming the recent 96% correlation between the two currency pairs is maintained,Wardle says.

The Mexican central bank could try once again to raise interest rates to support the currency, he adds, but this likely will have a limited effect in the face of a weaker dol-lar. Furthermore, support for President Vicente Fox is on the decline follow-ing allegations of illegal campaign funding in the 2000 election,Wardle says.These allegations are coming at a crucial time ahead of the July Congres-sional elections that will determine Foxs ability to pass key reforms, he adds.

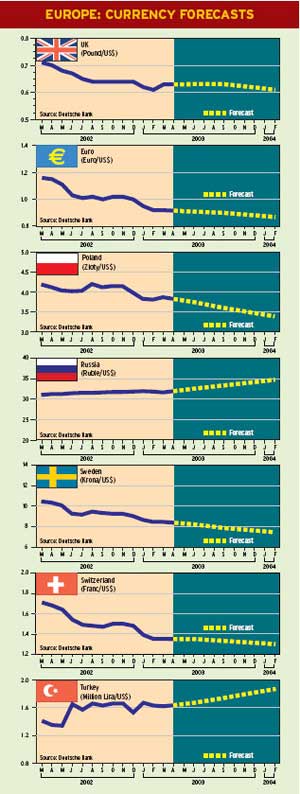

EUROPE Snows Remarks Boost the Euro

The euro rose to a four-year high above $1.10 in early March after US trea-sury secretary John Snow said he was not concerned about the dollars fall.

It is easy to conclude that the Bush administra-tion has peeled another layer of armor off the strong-dollar policy, says David Gilmore, partner and economist at Con-necticut-based Foreign Exchange Analytics.If the administration is guilty of anything on the strong-dollar policy, it is not its hidden desire to change it, but its inability or unwillingness to recog-nize the vulnerability of the dollar, Gilmore says.

The dollar could crash, and there is little pre-emp-tive planning to prevent a crash, much less contain one if it were to break out, he adds.

The main concern is the US current account deficit, which could reach $600 billion this year, according to Michael Rosenberg, head of global foreign ex-change research at Deutsche Bank in New York. Exchange rates ex-hibit a tendency to rise and fall over long-term cycles, often overshooting their purchasing-power parity by wide margins, he says.

Rosenberg predicts that the dollar will continue to fall through 2005, and that the euro will rise to $1.20 by the end of this year, before overshooting to $1.30 or $1.40 after that.

The widening of inter-est-rate differentials between Europe and the United States will aggra-vate the financing of the US current account deficit, he says.

Real short-term US rates are the lowest in the world and probably will get even lower, according to Rosenberg.Meanwhile, the US has gone from an investment boom to an investment bust and will have trouble attracting foreign capital, he adds.

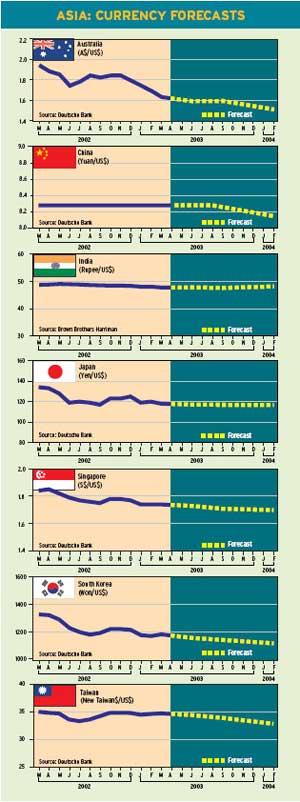

ASIA Will Bank of Japan Change Under Fukui?

The appointment of Fukui has drawn market criticism that monetary policy will remain conserv-ative and ineffective, says Grace Chen, analyst at Royal Bank of Scotland. Sig-nificantly, however, the gov-ernment also nominated former ministry of finance vice minister Toshiro Muto and former Tokyo Univer-sity professor Kazumasa Iwata as BOJ deputy gover-nors, Chen adds.

Fukui, president of Fujitsu Research Institute, has a reputation for being an independent thinker, she notes, and the new deputy governors will likely tip the central banks policy board in a more dovish bent.

Inflation may well be placed on the back burner for now, as fiscal prudence will remain a key guiding factor in the approach to monetary policy under the new BOJ team, she says. Still, wider purchases of unorthodox assets cannot be ruled out, Chen adds.

All indications are that the BOJ is continuing to intervene in the market, says Larry Kantor, head of global foreign exchange research at JPMorgan Chase in New York.

What is less clear, he says, is whether Japanese officials intend merely to defend current levels of the yen, moderate any decline, or try to drive it higher.With the Japanese stock market at a 20-year low, the yen is likely too strong for policymakers to accept, Kantor says.

Gordon Platt