THE AMERICAS

Oxford Metrica, a financial consulting firm, studied 767 depositary receipt programs over the past 23 years and found that such programs add an average of 10% to shareholder value in their first year of trading.

Upgrading a Level I program to a US-listed Level II or III program adds an additional 15% of value, as markets welcome the greater financial disclosure, according to the study, which was sponsored by Bank of New York.

De-listing a program destroys value by 25% on average over the course of the following year, the researchers found.

Oxford Metrica, with offices in Oxford, England, as well as New York, Geneva and Bermuda, says US-listed DRs improve liquidity by 32% on average, as visibility and access to an issuers stock increases and more equity analysts follow the company.

The research provides clear evidence that DR programs have provided huge benefits for a company in its domestic market, says Rory Knight, chairman of Oxford Metrica.

It is clear from the results that establishing a DR program,or upgrading an existing one, could provide a significant shareprice increase, Knight says.

The study also concludes that programs sponsored by Bank of New York outperform the programs of its competitors in both liquidity and shareholder value.

DRs also provide benefits to investors, such as reduced transaction costs, enhanced performance and greater portfolio diversification, according to Oxford Metrica.

The Oxford Metrica DR Composite index displays both higher risk and stronger returns than the Standard & Poors 500- stock composite over the past decade.

An investment of $100 million in the DR composite in March 1993 grew to $661 million 10 years later, whereas the same investment in the S&P; 500 would have risen to $189 million in the same period, according to the study.

EUROPE

London Exchange Woos US Firms

The London Stock Exchange announced a new fast-track admission procedure for smaller US companies listed on the New York Stock Exchange and Nasdaq.

These companies will be able to use their most recent report and accounts, such as a 10K filing with the US Securities and Exchange Commission and latest quarterly earnings report as a basis for a secondary listing on AIM, the London exchanges global market for smaller, growing companies.

The rule change is intended to encourage US companies, particularly those in the life sciences, technology, gaming and natural resources sectors, to join the London market, says Graham Dallas, head of business development for the Americas at the LSE.

The London markets are more institutional in character and should appeal to small US companies that lack an institutional following, Dallas says.

Trends show Londonbased investors are more open to investing in nondomestic companies than investors based in New York or Tokyo, he adds.

The fast-track route will also be open to companies listed on the main boards of the Australian Stock Exchange, Euronext, Deutsche Brse, JSE Securities Exchange (South Africa), Stockholmsbrsen Swiss Exchange and the Toronto Stock Exchange.

LSE-approved nominated advisers, known as nomads, will advise fast-track companies.These 69 advisers, mainly investment banks and broker/dealers, are obliged to ensure that the companies act in a suitable manner, Dallas says.

UK Companies Launch Programs

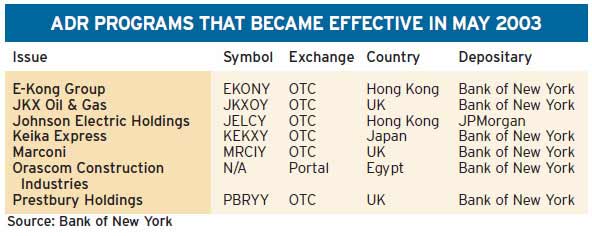

Three UK-based companies launched Level I American depositary receipt programs in the US over-the-counter market, all with Bank of New York as depositary.

JKX Oil & Gas began its program with a ratio of one ADR to 25 ordinary shares. JKX has exploration and production assets in Ukraine, Georgia and Russia, as well as license interests in Italy and the US.

The company has invested $100 million in Ukraines oil and gas sector since the mid-1990s and is the largest UK investor in Ukraine.

Marconi, the British telecom- equipment maker that emerged from a financial restructuring in May, began its program at a ratio of one ADR to 10 shares.

Prestbury Holdings, a financial services group that trades on the London Stock Exchanges AIM market, also launched at a ratio of 1:10.

ASIA

Keika Express Pulls Into OTC

Osaka, Japan-based Keika Express, a distribution service company, initiated a Level I program in the US over-the-counter market.

One ADR is equivalent to one common share, according to the sponsor, Bank of New York.

The Japanese company contracts with owneroperators of light trucks and acts as a forwarding agent for companies seeking to outsource distribution of their products and other transportation needs.

AFRICA

Egyptian Company Makes Placement

Cairo-based Orascom Construction Industries selected Bank of New York as depositary for its Rule 144A program for securities not registered with the US Securities and Exchange Commission.

The depositary receipts trade on the National Association of Securities Dealers Portal system.

Orascom is involved in numerous construction projects in the Middle East and North Africa, including luxury hotels and power plants.

The company also manages port facilities and manufactures building materials.

Orascoms shares are traded on the Cairo & Alexandria Stock Exchange.

Gordon Platt