Award Winners

World’s Best Private Banks 2026: Global Winners

Despite uncertain times, AI helps wealth managers deliver top-flight performance.

Global news and insight for corporate financial professionals

Join the global community of corporate and public-sector finance industry leaders reading Global Finance monthly in print.

Click Here

Award Winners

Award Winners

Executive Interviews

Executive Interviews

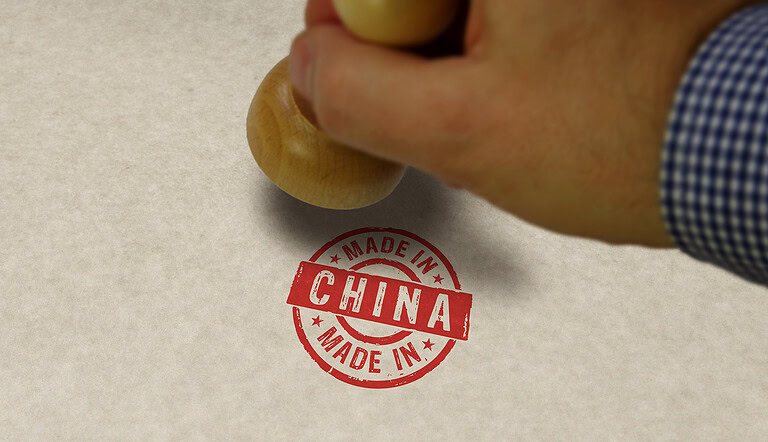

Emerging & Frontier Markets

Emerging & Frontier Markets

Economics, Policy & Regulation

Features

Awards

Award Winners

Economics, Policy & Regulation

Economics, Policy & Regulation