|

MIDDLE EAST REGIONAL REPORT

RECESSION PROOF

Saudi Arabia epitomizes the trend toward big spending on infrastructure by oil-rich nations that is keeping their economies afloat.

By Gordon Platt

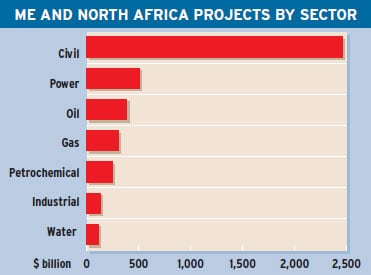

The Middle East is not immune to the effects of the global economic slowdown, but the fallout is being felt less in the region than almost anywhere else, as the oil-exporting countries continue to spend heavily on investment in infrastructure to keep their economies growing. The six member nations of the Gulf Cooperation Council (GCC) are dipping into their substantial reserves accumulated during the oil-price boom, which ended abruptly last July. Massive investments in infrastructure and continuing economic reforms will position the region to compete more effectively in the global economy during the coming recovery, economists say.

Saudi Arabia, the world’s biggest oil exporter and the largest economy in the Middle East, plans to spend $400 billion on infrastructure projects in the next five years. The kingdom is stepping up spending to stimulate growth and to take advantage of lower construction costs, with steel and cement prices well below their levels of six months ago. The Saudi authorities are pulling out the stops to keep the economy expanding and diversifying into new areas to create employment for the kingdom’s fast-growing and youthful population, which has a median age of 21. Some 38% of the population of 28 million is under the age of 14.

While it is a member of the GCC, Saudi Arabia should not be lumped together with the smaller economies of the Gulf, says John Coverdale, managing director of Riyadh-based SABB, the Saudi British Bank, and deputy chairman of HSBC in Saudi Arabia. HSBC has appointed Coverdale global co-head of commercial banking, based in Hong Kong, effective April 6.

Saudi Arabia accounts for more than half of the gross domestic product of the GCC, and the kingdom is a major manufacturing nation, Coverdale says. The other members of the GCC are Bahrain, Kuwait, Oman, Qatar and the United Arab Emirates.

In addition to its petroleum wealth, Saudi Arabia has ample non-oil natural resources on its massive peninsula, Coverdale says. Ma’aden, the Saudi mining company that uses the country’s bauxite resources to produce aluminum, also owns five precious metals mines and has identified 10 million ounces of gold reserves.

Coverdale says he is sanguine about the underlying fundamental strength of the Saudi economy. “The country has a strong government that is intent on developing infrastructure with revenue from a variety of sources,” he says. “It doesn’t lurch from one trend to another but moves steadily forward.”

Saudi Arabia has a strong local workforce, with eager participants from the south and other poorer regions of the country, Coverdale says. It also has a wide range of industries, and its railroad tracks and highways need constant rebuilding due to the harsh desert climate.

“The impact of the global financial crisis here is rather less [than elsewhere], not because the country is cocooned but because it is cushioned due to the fact that it has been a more closed society,” Coverdale says. It has been only three years since Saudi Arabia joined the World Trade Organization.

Looking East

|

|

Beddington: Oil prices have probably already bottomed |

Saudi Arabia is increasingly looking to the East to find growing markets for its oil and petrochemicals, says John Sfakianakis, SABB’s chief economist. China has become a powerful trading partner and is the second-largest source of Saudi imports and its fifth-largest export customer. “China is an exporter of goods, and Saudi Arabia is a significant importer, while China’s growth and thirst for oil imports has been largely supplied by Saudi Arabia,” Sfakianakis says. Over the past nine years, Saudi exports to China have grown by 963%.

More than 70 China-based companies are doing business in the kingdom, including 62 construction firms employing close to 16,000 low-cost Chinese laborers, Sfakianakis says. A Saudi-Chinese consortium recently won the $1.8 billion civil works contract for the first phase of the $6 billion Haramain Railway project, a high-speed railway linking the holy cities of Mecca and Medina. The Al Rajhi consortium, which includes France-based Alstom and China Railway Engineering, will lay rail lines from Mecca to Medina, passing through Jeddah and King Abdul Aziz International Airport. The project will ease transportation problems faced by millions of pilgrims each year.

In the medium term China’s dependence on Saudi and GCC oil will continue to rise, according to Sfakianakis. “Gradually, China is also recognizing that the effects on Saudi Arabia of the global economic crisis are minimal,” he says. “The kingdom stands as the most unscathed member of the Group of 20 [major economies].”

Both China and Saudi Arabia have accumulated massive foreign reserves, mainly in US government debt, and both countries need to deal with the shifting economic balance of power from the United States and the West, Sfakianakis says. China and Saudi Arabia are naturally being drawn closer together, he says. For the moment, however, the roles of the US and China in the Middle East region are not mutually exclusive.

Investment opportunities are growing for local and international companies throughout the Arab world. Saudi Arabia is seeking to attract sufficient investment to achieve rapid and sustainable economic growth by granting foreign investment projects the same benefits and incentives available to locally owned projects, including the availability of land in new industrial cities at nominal charges.

The Saudi Arabian General Investment Authority (Sagia) signed six agreements on February 24 to develop the Prince Abdulaziz bin Mousaed Economic City in the northern province of Hail. The economic city, to be completed by 2025, will be a major industrial hub and logistics center, with an airport serving the northern part of the country. The $53 billion project is intended to create jobs and to help balance regional development. Al-Mal, the investment arm of Kuwait-based M.A. Kharafi Group, and Diyar Al-Kuwait Real Estate plan to build four residential and commercial towers in the new city.

After signing the contracts, Amr al-Dabbagh, governor of Sagia, said, “The economic cities are a vital ingredient in the future of Saudi Arabia.” Sagia is developing six new cities, the largest of which is the King Abdullah Economic City, a $130 billion development at a site near Rabigh, 60 miles northwest of Jeddah. Emaar Economic City, a consortium set up by Dubai-based Emaar Properties and Saudi Aseer, will manage the project. Emaar Economic City raised $2 billion in an initial public offering in August 2008. The new city will have six components: a major seaport on the Red Sea, a central business district, an industrial zone, an educational district, resorts and residential communities. Some residential units have already been sold, although the city will not be completed for another 20 years. The first apartments and offices will be ready later this year.

Limitless, the real estate development arm of Dubai World, is building a $12 billion urban community on a site north of Riyadh that is a 15-minute drive from the airport. The development, known as Al Wasl, will include 55,000 new homes, as well as offices, hotels, mosques, shopping malls, schools and a hospital. Nearly 5 million people are living in Riyadh today, and the city’s population is increasing by 150,000 a year.

Limitless, the real estate development arm of Dubai World, is building a $12 billion urban community on a site north of Riyadh that is a 15-minute drive from the airport. The development, known as Al Wasl, will include 55,000 new homes, as well as offices, hotels, mosques, shopping malls, schools and a hospital. Nearly 5 million people are living in Riyadh today, and the city’s population is increasing by 150,000 a year.

“There is enormous pent-up demand for housing in Saudi Arabia, where less than 30% of the people own their own homes,” says Maurice Horan, general manager and head of strategic investments at Riyadh-based Arab National Bank (ANB). “Because we did not have a fine-tuned mortgage industry, we haven’t had the excesses seen elsewhere,” he says.

In 2007 ANB set up a mortgage firm, Home Finance, with Dar Al-Arkan, a leading real estate developer in Saudi Arabia, and the International Finance Corporation, the commercial lending arm of the World Bank. Home Finance is the largest Islamic property-financing company in the region.

Saudi Arabia’s first mortgage law could be enacted by the end of this year, unlocking big real estate lending potential. A draft law has been in the works for nearly a decade and was approved last year by the advisory Shura Council. The measure is now being examined by the Council of Ministers and must be ratified by royal decree and found to be fully compatible with shariah law before it can go into effect.

ANB’s earnings rose 1% last year to $663 million, but 2009 could be a more challenging year for everyone across the globe, including in Saudi Arabia, Horan says. “Our client base is not immune to the global economic slowdown,” he says. “We will be very vigilant in maintaining the quality of our loan book.”

Banks Provide a Role Model

Saudi Arabia’s highly regulated banking industry is in very strong condition, Horan says. The kingdom is the only major emerging market with no failing banks. “One reason for this is that SAMA [the Saudi Arabian Monetary Agency] is a strong and wise regulator,” he says. SAMA, the central bank, has taken a highly conservative approach to bank regulation, which is likely to continue under its new governor, Muhammad al-Jasser, who was previously deputy governor under Hamad Saud al-Sayyari and who was promoted as part of a broad cabinet reshuffle in February.

SAMA has broad regulatory powers in licensing banks, approving their activities and taking prompt corrective action when required. It has the power to issue rules and regulations in all areas of banking, including capital adequacy, liquidity, lending limits and credit and market risk. It also provides central payment and settlement services. The Saudi banking model, with its emphasis on systemic stability, could serve as a model for revamped banking systems in the West.

|

|

Al Sowailim: Believes in building an empowered investor community |

Deficit Looms

Saudi Arabia’s record 2009 budget will be in deficit for the first time since 2002 and includes a 36% increase in capital spending to support the government’s infrastructure program. The budget includes funds for 1,500 new schools and 86 hospitals. It also includes appropriations for roads and traffic lights, ports, airports, railroads and new postal services.

|

|

Coverdale : Saudi Arabia doesn’t lurch from one trend to another |

PRIVATE EQUITY EXPANDING ITS FOOTHOLD IN THE REGION

The Middle East’s private equity market is small relative to the size of the region’s economies. It offers growing opportunities for investors, however, as regional businesses seek new sources of funding in the credit crunch and as initial public offerings are difficult to arrange in current market conditions.