The world’s best debt banks rode surging new issuance volumes in 2020 and moved to address investors’ demand for green and sustainable bonds.

A pandemic, with lockdowns, travel restrictions and the ensuing economic downturn made 2020 a challenging year across the business spectrum; and debt capital markets (DCM) weren’t exempt.

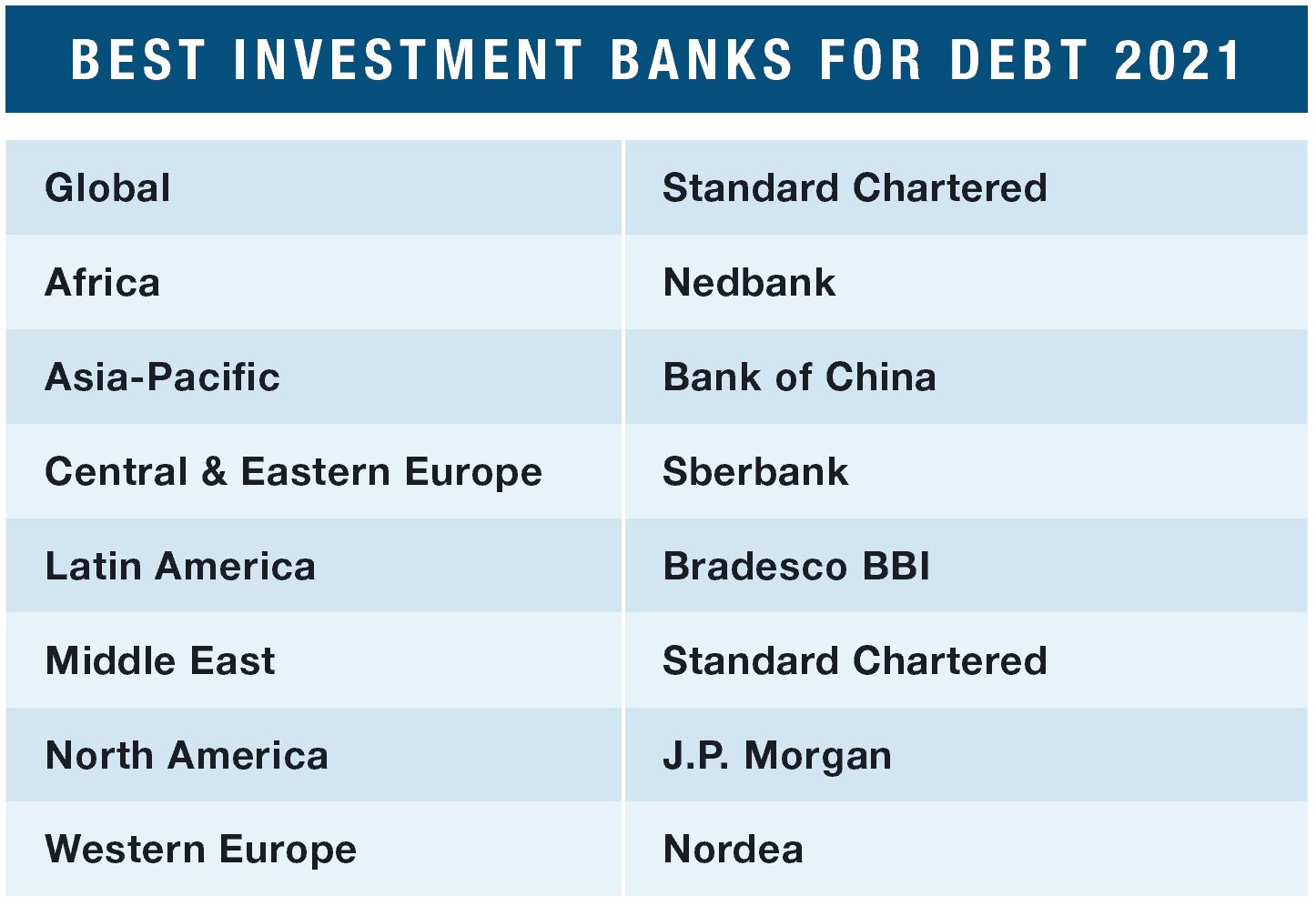

The top DCM investment banks, notably Global Finance’s 2021 Best Investment Banks in this category, made do, however.

“We knew that the liquidity position in the global debt markets was healthy and further buoyed by the support of the [US] Federal Reserve’s sharp reduction in rates,” says Salman Ansari, managing director and head of capital markets for the Middle East and North Africa (MENA), Europe and the Americas at Standard Chartered, “so we worked with our clients to identify the most appropriate strategy to take advantage of that funding.”

Standard Chartered earned the title of Best Debt Bank globally as well as the Best Debt Bank in the Middle East by working on some of the biggest debt issues of the year, including Qatar’s $10 billion bond in April and others for the United Arab Emirates (UAE) and Saudi Arabia. Standard Chartered topped Refinitiv’s MENA bond underwriters ranking in 2020 with $21.4 billion of related proceeds and an 18% market share.

In June, it also acted as senior mandated lead arranger for the acquisition financing facility on the region’s single largest energy infrastructure investment and one of the largest in the world last year: an Abu Dhabi National Oil Company (ADNOC) gas pipeline project that is projected to bring $10.1 billion in investment to the UAE.

Having come through a uniquely difficult year in 2020, global debt banks may now face a similar one, according to Ansari. This year will see an “even more volatile backdrop in rates as investors grapple with the likelihood of rising inflation in the short to medium term,” he says.

“The Covid-induced crisis has inflicted considerable strain on emerging markets as global investors look to safe-haven assets until the spread of the virus is contained,” says Brad Maxwell, managing executive of investment banking at Nedbank, this year’s Best Debt Bank in Africa. Nedbank’s corporate and investment banking unit has made a special effort to work closely with clients “to see them through a turbulent year,” he adds. Nedbank is the fourth largest bank in South Africa and the first bank in South Africa to issue a renewable-energy bond.

Nedbank became the first South African issuer to join Nasdaq’s Sustainable Bond Network. The bank also worked to strengthen its environmental, social and governance (ESG) standards, Maxwell says, noting that it was already the first bank on the continent to adopt the Equator Principles, a risk management framework used to assess environmental and social risk in large projects. Nedbank was Africa’s first carbon-neutral bank and had belonged to the Dow Jones Sustainability Index for 16 years.

Bank of China (BOC), Global Finance’s Best Debt Bank in the Asia Pacific region, ranked 15th globally among bookrunners last year with $178.7 billion in proceeds and 2,345 deals: tops among Chinese banks, according to Refinitiv. Many of its deals were for state-owned Chinese concerns, including State Grid Corporation of China, an electric utility, for which BOC acted as global joint coordinator on a $3.3 billion jumbo bond deal.

BOC has traditionally been the strongest of China’s Big Four banks in international debt financing. Reportedly, it has been looking to increase staff in its offshore bond business of late and developing more resources in settlement, market-making and credit research. BOC is also a perennial leader in the Panda market, bringing foreign issuers to the domestic renminbi-denominated bond market; last year, it again led all banks in the category.

When Russia tapped the global debt markets for the first time in 2020, the two sovereign eurobond issues were co-arranged by Sberbank, Global Finance’s Best Debt Bank in Central and Eastern Europe in 2021.

The two euro-denominated bonds came to market in November with bids that exceeded €2.7 billion ($3.2 billion): a warm greeting given that Russian eurobonds often have liquidity issues and the US government has forbidden American banks from buying them directly, although they can do so on secondary markets.

The Russian government has also been issuing ruble-denominated bonds in the domestic market recently to alleviate its budget shortfall; and in this sector, too, Sberbank has been a leader. It was the world’s second-largest bookrunner by ruble-denominated DCM volume in 2020, up from third in 2019, according to Dealogic, with 77 deals and a 15% market share. In January of this year, it was an organizer in the first offering of a social eurobond by a Russian issuer: Sovcombank’s $300 million placement.

The green bond market has also been developing recently in Russia.

“The Bank of Russia, the Moscow Exchange, VEB.RF and other entities have developed a taxonomy of green projects and infrastructure for the green financing market, including green bonds,” says Eduard Jabarov, co-head of global DCM at Sberbank, although “further measures to support the market are required in order to stimulate demand from local investors and ensure a significant impetus for the issuers to place ESG bonds.” These include preferential taxation of income on ESG bonds and easing the accounting rules and requirements for banks and investment companies, he says.

Universal bank Nordea is a powerhouse in the Nordic region and beyond, earning it the title of Best Debt Bank in Western Europe. The Helsinki-based institution was the No. 1 bookrunner in Swedish krona-denominated DCM by volume in 2020, according to Dealogic; and second in the corresponding Norwegian market. It also ranked first in both All-Nordic investment-grade DCM volume by bookrunner and All-Nordic high-yield DCM volume, Dealogic reports.

Nordea was a player in the green bond and sustainability sector last year as well, ranking 25th among global bookrunners in the green bond category, with 36 deals generating $3.1 billion in proceeds in 2020, according to Refinitiv. In August, it arranged the first sustainability-linked leveraged buyout loan in the Nordic region; and it has committed as a corporation to “a net-zero emissions objective by 2050 at the latest.”

Bradesco BBI, Best Debt Bank in Latin America, was responsible for $22 billion-plus in local and international DCM deals last year, mostly on behalf of Brazilian corporations. In the Latin American regional market, the bank ranked third among bookrunners in 2020 by DCM volume, with $2.1 billion spread across 28 deals for an 11.7% market share, according to Dealogic.

Bradesco BBI was also an active player in Brazil’s record issuance of green and sustainable bonds in 2020. By September, Brazil had already surpassed total green bond issuances in the previous year as ESG concerns gained traction with investors. In DCM roadshows, says Philip Searson, managing director and head of fixed income at Bradesco, “companies have been much more questioned about negative socioenvironmental externalities and how they move to generate positive impacts,” and the Covid crisis has only raised their level of concern.

J.P. Morgan, the largest bank in the US and 2021 Best Debt Bank in North America, once again dominated DCM by several measures. It was the world’s top bookrunner in DCM with $685.5 billion in proceeds on 2,568 deals and a 6.7% market share, according to Refinitiv.

The US debt capital market is immense; and in 2020 it grew 37% year-on-year, according to Dealogic, with volume of $4.3 trillion that dwarfed Europe, the Middle East and Asia. Europe is the second largest region at $2.5 trillion. J.P. Morgan was the top bookrunner in the US DCM market, with revenue of $2.2 billion and a 12.4% market share; and it also led in US DCM by volume, at $500.3 billion across 1,946 deals and an 11.7% market share. The bank was the leader in other categories too, including US investment grade debt, US high-yield corporate debt, US mortgage-backed and asset-backed securities.

Where will the market take 2021 DCM leaders? Continuing fiscal stimulus could lead to further interest rate growth across the globe, says Olga Gorokhovskaya, managing director and co-head of DCM at Sberbank CIB. That could pose a “key challenge for the public debt markets,” she warns, affecting issuers’ desire to seek new financing. On the other hand, given “the strong economic recovery that is shaping up, risk appetite should remain healthy, which would support primary DCM markets.”