FOREIGN EXCHANGE

|

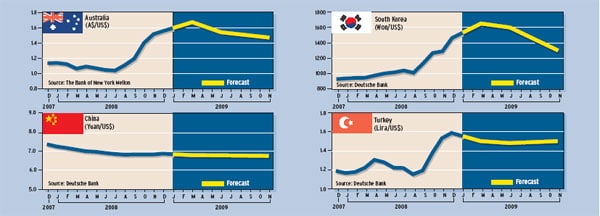

A persistent shortage of dollars in global money markets is helping to bolster the greenback, even as US economic data portray an economy that is mired in recession, currency analysts say. The dollar continues to benefit from a global rush to the safe haven of US treasury securities as investors pull funds out of more-risky emerging markets.

A widespread international dollar shortage emerged after the Lehman Brothers bankruptcy in September as US money market funds, which are major providers of liquidity to European banks, began to hoard liquidity following a wave of redemptions, says David Woo, London-based head of global foreign exchange strategy at Barclays Capital, the investment banking division of Barclays Bank. This contributed importantly to the sharp rise in the dollar in October, he says.

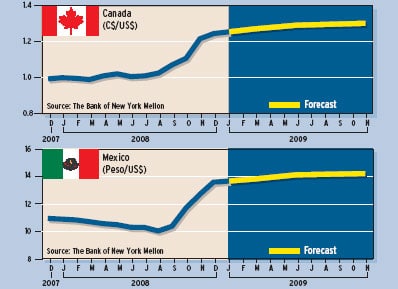

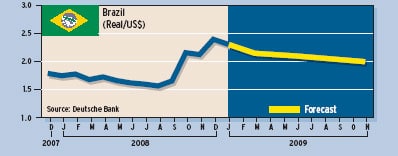

Meanwhile, a worsening of the balance of payments positions of developing countries is exacerbating the dollar shortage offshore, according to Woo. “Given that the rapid accumulation of reserves by these countries in recent years provided an important and stable source of dollar funding for European banks, the fact that their reserves are either increasing more slowly, or actually falling, would tend to reinforce the offshore dollar shortage,” he says.

The combined reserves of Brazil, Russia, India and China, the big emerging markets known as the BRIC countries, fell by $140 billion in October, the biggest monthly fall on record, according to Woo. This is unlikely to be a fluke, he says, as falling commodity prices and slowing global demand for manufactured goods will hit both commodity exporters, such as Russia and Brazil, and manufacturing exporters, such as China and India, alike.

“Whatever the reasons behind the continued dollar shortage, we see a significant easing of the shortage as a precondition for a sustainable dollar sell-off,” Woo says. While the balance of risks for the dollar in the near term points to continued gains, the dollar will be vulnerable in 2009, he says. Quantitative easing by the Federal Reserve exposes the dollar to potentially huge risks, he adds.

Quantitative easing occurs when the Fed shifts its focus from the price of reserves, or the level of interest rates, to the quantity or growth of reserves. Even if the federal funds rate falls to zero, the central bank can continue to ease its policy by increasing reserves beyond the amount required to keep the rate at zero.

With interest rates among major economies converging further in the next few months, relative fiscal policies will become a primary driver for the dollar against many currencies, Woo says. “We are concerned that a very large fiscal stimulus package under [president-elect Barack] Obama will call into question the sustainability of US debt dynamics and think the record issuance of US government debt [in 2009] will likely serve as the catalyst for the start of renewed dollar weakening,” he says. “However, we do not share the belief that the dollar rally is about to reverse quickly.”

The possibility that the US government may have trouble securing financing for an ambitious fiscal package and will turn to the Fed as a lender will weigh heavily on the dollar, particularly if the Obama administration decides to get tough on trade issues with China, which still holds a huge amount of US government debt, Woo says. Barclays Capital is projecting record US treasury issuance of $1.5 trillion in 2009.

The US employment report for November, with the biggest decline in non-farm payrolls in 34 years, as well as historical downward revisions to previous months’ data, sent a tremor throughout global financial markets, pushing the dollar higher across the board on renewed risk aversion, says Michael Woolfolk, senior currency strategist at The Bank of New York Mellon.

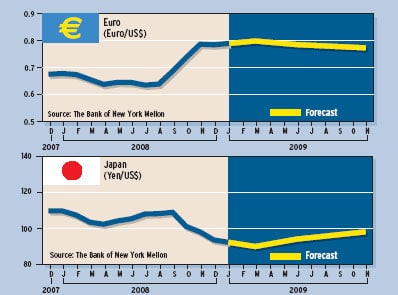

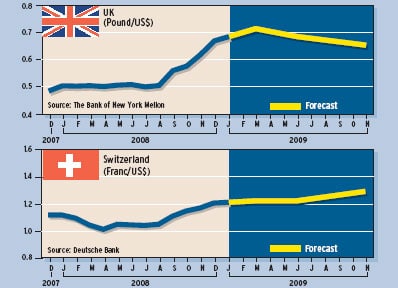

“Deteriorating economic fundamentals in the United States and overseas are adding to risk aversion, thereby benefiting the dollar and the yen,” Woolfolk says. “And aggressive monetary easing by central banks overseas is also benefiting the dollar and the yen from a rate differential view,” he says.

With the Bank of Japan expected to bolster its smoothing operations to prevent a sustained break of the level of 90 yen to the dollar, the greenback is expected to take the most-favored status among the major currencies as the global recession gathers strength, according to Woolfolk.

The yen is likely to continue to appreciate in 2009 in the face of ongoing economic and financial uncertainty, according to Lewis Alexander, chief economist at Citi. “The economy has deteriorated sharply in the wake of the almost unprecedented stress in the core of the global financial system,” he says. “We are in the midst of a major global recession.”

Market participants are far too sanguine about the euro area, Alexander adds. “Consequently, we expect further weakening of the euro against the dollar,” he says. Most emerging market currencies should remain under pressure until the outlook for global risk appetite stabilizes, he adds.

In their 2009 outlook, Citi economists noted that longer-term interbank borrowing rates remain elevated relative to market expectations for overnight interest rates. This suggests that market participants do not expect liquidity pressures to ease materially in the foreseeable future, they said.

The Fed’s quantitative easing policy reached a new landmark in late November when the central bank announced the purchase of up to $500 billion in government-sponsored enterprise mortgage-backed securities and an additional liquidity facility of up to $200 billion in new lending to consumer asset-backed securities, says Ashraf Laidi, chief foreign exchange strategist at CMC Markets US, based in New York.

“The Fed’s balance sheet has grown by over $1.3 trillion so far this year and is well on its way to following the Bank of Japan’s policy of quantitative easing—targeting the quantity of money rather than its price,” Laidi says.

This followed an earlier move by the Fed to more than double its swap lines to foreign central banks to $620 billion. “Dollar funding rates abroad have been elevated relative to dollar funding rates available in the United States, reflecting a structural dollar funding shortfall outside of the United States,” the Fed said in its statement announcing the action.

“The increase in the amount of foreign exchange swap authorization limits will enable many central banks to increase the amount of dollar funding that they can provide in their home markets,” the Fed said. “This should help to improve the distribution of dollar liquidity around the globe.”

|

Gordon Platt