Market Focus | Middle East Investment Banking

Jump To Section

Seeking Out The Silver Linings

What’s Driving Middle Eastern M&A?

GCC Countries Use IPOs To Distribute Oil Wealth

Although investment bankers remain cautious about Middle Eastern prospects in the wake of falling oil prices, M&A activity and debt issuance remain bright spots.

Middle Eastern investment bankers are looking on the bright side of things, following

the damage to regional financial markets caused by the steep drop in oil prices and a cloudy economic outlook. Most of the Gulf Cooperation Council (GCC) countries have substantial monetary reserves and have said they will continue high levels of government spending. These countries could speed up efforts to diversify their economies, stimulating growth of the non-oil sector, bankers say. Nonetheless, some planned equity issues have been shelved owing to the market turmoil, and a sense of caution prevails.

The planned opening of Saudi Arabia’s stock market, the Tadawul, to investors from outside the region by the end of June could attract billions of dollars of inflows. The $500 billion Tadawul in Riyadh, which trades the shares of 163 companies, is by far the largest and most active exchange in the region.

GCC debt markets remain a safe haven, bankers say, and there is a possibility that anticipated budget deficits will lead to more issuance by entities in both the public and the private sectors. The limited supply of debt has been outrunning demand in recent years, especially for sukuk. With investors buying and holding on to new issues, the secondary market has had a tough time developing. An increase in supply may help solve this problem.

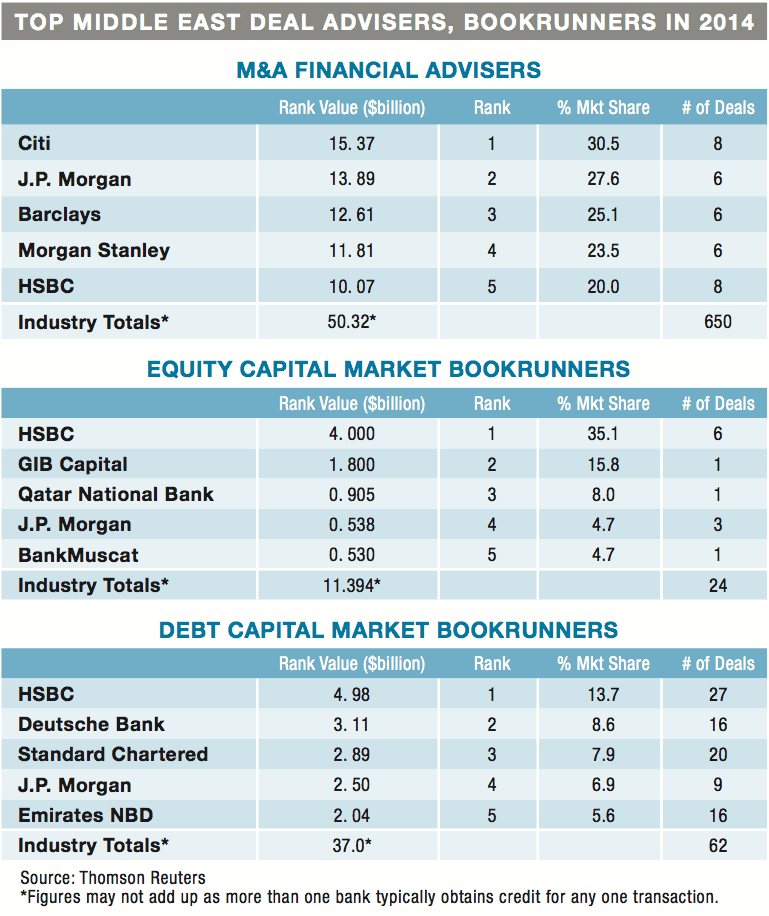

There was a 23% rise in the value of announced mergers and acquisitions in the Middle East in 2014, compared with 2013, according to Thomson Reuters. Qatar’s overseas acquisitions accounted for 65% of the region’s outbound M&A activity last year. The largest deal was the Qatar Investment Authority’s and Brookfield Property Partners of Canada’s successful $4 billion bid for Canary Wharf, London’s financial district.

“As Middle Eastern markets, particularly those in the GCC, become more and more important as global hubs, I expect we will see more cross-border mergers and acquisitions into and out of the region,” says Michael Katounas, deputy CEO and head of investment banking at QInvest, a leading Qatar-based Islamic investment bank and asset manager.

“Families and private wealth will play an increasing role, both for intra-MENA [Middle East and North Africa] transactions and for outbound investments to Europe and the United States,” Katounas says. “Last year was hugely exciting for those in the Islamic finance space, with 19 jurisdictions tapping the global sukuk market, the highest number ever. We expect increased external financing in the region as a result of budget cuts, and the Islamic market is likely to get more than its fair share of the pie, given the ample liquidity that is looking for a home,” he says.

In Qatar, government spending linked to strategic projects is unlikely to be affected by oil price fluctuations, Katounas says. “At the same time, the diversification of the economy away from hydrocarbons and the increased sophistication of project financing are likely to push for a higher involvement of the private sector, either through direct equity or debt investments, or through public-private partnerships,” he says.

In Kuwait, growth in investment banking will depend on the government’s commitment to infrastructure spending, as well as on regional political stability and improved market performance, says Manaf Alhajeri, CEO of Markaz, a Kuwaiti investment bank and asset manager. “The Kuwaiti government is expected to finance 523 projects for the country’s five-year development plan—from 2015 to 2020—and has set aside $155 billion, with the capital spending calculated on a budgeted oil price of $45 per barrel,” Alhajeri says. “In 2015 the government plans to spend about $22.5 billion, of which $7.2 billion will be directed toward construction.”

To further support spending, the Kuwaiti government is considering slashing subsidies on gas and utilities, following announcements of reduced subsidies on diesel, kerosene and aviation fuel. “The government wishes to diversify its income sources by improving the private sector and has planned its spending over the next five years to that end,” Alhajeri says. “But it remains to be seen whether the implementation will be successful.”

Kuwait’s equity market remains undervalued, compared with those of its regional peers, according to Alhajeri. “Corporate earnings have lagged behind other GCC countries, and investors hope for a reasonable increase in earnings, which would aid market performance,” he says. Equity capital market issuance in the Middle East rose 173% last year to $11.4 billion, according to Thomson Reuters. The total was boosted by the record $6 billion issue by National Commercial Bank in Saudi Arabia. IPO activity is expected to lag in 2015 but could pick up once market conditions improve.

WAIT-AND-SEE APPROACH

“Some companies decided to delay or abort their IPO plans in the fourth quarter of 2014 due to declining oil prices,” Alhajeri says. “Both international and regional investors are wary of downward-trending oil prices and the resultant impact on infrastructure spending. Companies have adopted a wait-and-see approach, with the hope that oil-price volatility settles down soon,” he says.

Investors are also concerned about a potential interest-rate increase by the US Federal Reserve, but Alhajeri says relatively strong growth in emerging markets and accommodative monetary policies in Japan, the European Union and China will counter any Fed tightening. “With close to $19 billion of debt maturing in 2015, we expect money to continue to flow to the regional bond markets,” he says.

If the oil price slide has a truly bright side for the region, it is the major benefit it provides to such oil-importing nations as Egypt, Jordan and Lebanon. “The Egyptian stock market has rallied recently, buoyed by the economy’s brightening prospects and hopes that the central bank’s decision to loosen its grip on the pound marks a shift toward more orthodox policymaking,” says Jason Tuvey, Middle East economist at London-based economic research company Capital Economics.

It appears that Egyptian policymakers are trying to restore external competitiveness by breaking the pound’s effective peg to the rising dollar, Tuvey says. The currency needs to fall to around 8.25 to the dollar to restore competitiveness, he says.

Capital Economics expects oil prices to rebound to around $60 per barrel by the end of this year. “While this should provide some support to equity markets in the Gulf, we’re not going to see a repeat of the large gains seen in recent years,” Tuvey says. “After all, economic growth looks set to slow. And lower oil prices will continue to hit the revenues of petrochemical companies, which, in the case of Saudi Arabia, make up around a fifth of the stock market,” he says.

Jump To Section

Seeking Out The Silver Linings

What’s Driving Middle Eastern M&A?

GCC Countries Use IPOs To Distribute Oil Wealth

What’s Driving Middle Eastern M&A?

Positive changes in the regulatory environment and further opening to foreign investors are among the factors market participants cite for expecting a significant increase in mergers and acquisitions in the Middle East this year. Following a 23% rise in the value of deals announced in 2014, the momentum is expected to continue to build, as the rules of the game are clarified.

Middle East regulatory regimes are becoming more sophisticated, which will make M&A transactions more complex and interesting, says Christopher Lester, an attorney at Latham & Watkins in Abu Dhabi. The United Arab Emirate’s new competition law recently introduced a merger-control regime that reflects many international norms. However, the competition law does not apply to government-related entities, oil and gas companies, utilities and many other important market sectors.

The UAE, Saudi Arabia and Egypt will be the focus of regional M&A transactions in 2015, says Manaf Alhajeri, CEO of Kuwaiti investment bank Markaz. “Economic reforms, liberalization of foreign investment, and an abundance of liquidity in the banking system will spur growth in M&A activity.”

Sectors that should see strong M&A activity this year include real estate, financial institutions, education, healthcare, pharmaceuticals and food and beverage companies, according to Alhajeri. “Intraregional deals from domestic family businesses and inbound deals from private equity funds based in the US and Europe are set to rise this year,” he notes.

Qatar Airways, for example, plans to continue its rapid expansion in Europe. The airline recently bought a $1.7 billion, 10% stake in International Consolidated Airlines Group (IAG), owner of British Airways and Iberia.

Jump To Section

Seeking Out The Silver Linings

What’s Driving Middle Eastern M&A?

GCC Countries Use IPOs To Distribute Oil Wealth

GCC Countries Use IPOs To Distribute Oil Wealth

State-owned Qatar Petroleum plans to list four companies in the next 10 years, as Qatar seeks to develop a long-term savings and investment culture and distribute its hydrocarbon wealth to the country’s citizens. The national oil and gas company floated a 26% stake in its Mesaieed Petrochemical Holding subsidiary last year, raising $880 million in the country’s biggest initial public offering in five years.

The petrochemical company’s IPO was restricted to Qatari nationals, including minors, who face limits on selling the shares before they become adults. Priced at a significant discount, the shares rose fivefold in their first day of trading on the Qatar Exchange. Foreign investors are allowed to trade Mesaieed’s shares, now that they have been listed.

The equity markets play a dual role in the region, providing capital for issuers and liquidity for equity investors, just as they do in developed economies, as well as acting as a wealth-distribution mechanism from the state to the general public, says Michael Katounas, deputy CEO and head of investment banking at asset manager QInvest. “Although oil prices clearly affect perceptions of wealth, significant diversification has taken place in the last few years, with non-oil national champions offering an attractive way to invest in the consumer growth of the region,” Katounas says. “It is those industrial or service-driven corporates that will generate an increased level of demand in the equity capital markets.”

Equity capital market issuance in the Middle East rose 173% last year to $11.4 billion, according to Thomson Reuters. There were 13 initial public offerings, including a $6 billion offering by Jeddah-based National Commercial Bank that was the largest ever in the region. The previous record IPO was the $5 billion offering by Dubai’s DP World in 2007.

HSBC Saudi Arabia and GIB Capital were the financial advisers and lead managers for the sale of a 25% stake in NCB, the largest lender in Saudi Arabia. The IPO was limited to Saudi investors. Of the 500 million shares sold, 200 million shares were allocated to the Public Pension Agency, with the remaining 300 million shares reserved for individual investors. Retail investors placed orders for more than 23 times the shares offered for sale, despite a ruling by religious leaders that the IPO was forbidden under Islamic law, which bans the charging of interest. NCB plans to convert to a fully Islamic bank within five years.