Top Middle Eastern banks are streamlining corporate services and scrambling to meet rising demand for self-service solutions.

Every economic crisis becomes a liquidity crisis, forcing banks and their corporate customers to take measures—some innovative—to maintain cash flow during the emergency. To help expand its liquidity management capabilities after the Covid-19 crisis hit last year, First Abu Dhabi Bank (FAB) launched intercompany lending capabilities powered by Intellect Global Transaction Banking’s (iGTB) Digital Transaction Banking solution.

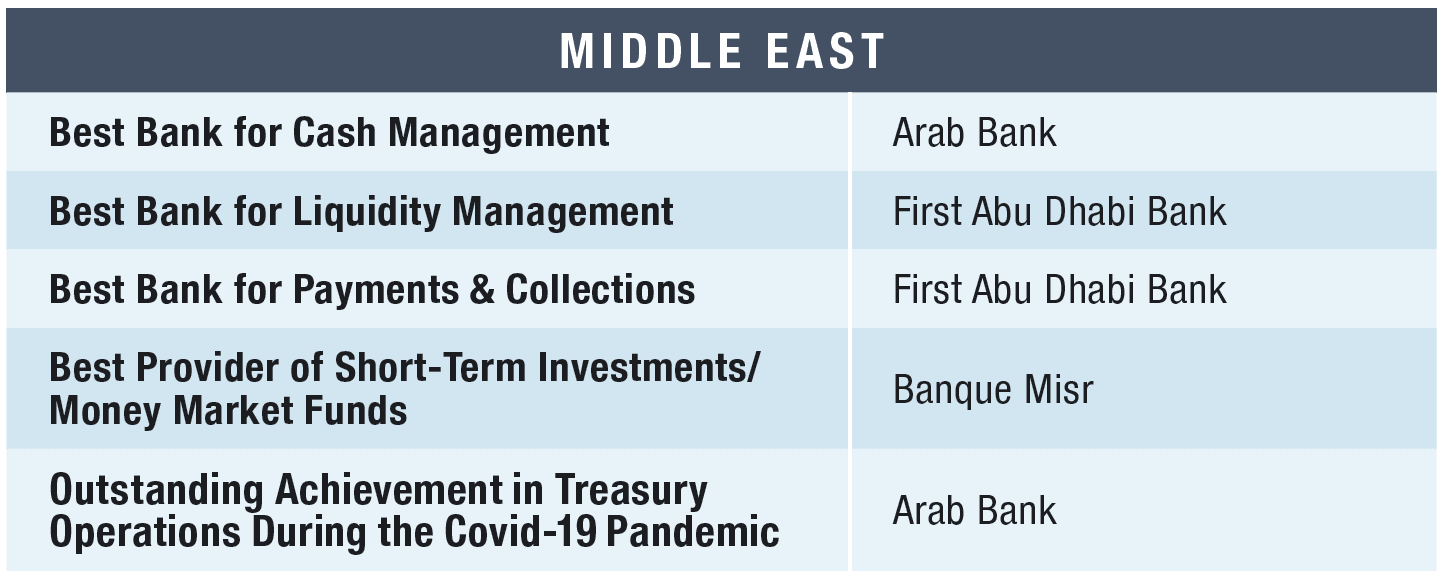

For FAB, Global Finance’s 2021 Best Bank for Liquidity Management and Best Bank for Payments and Collections in the Middle East, this means it can automate borrowing and lending transactions for its top corporate clients. It can also track loan agreements, rules and parameters regarding borrowing capacity, debt structure, repayments and facility limits, while improving cash visibility, real-time cash forecasting and centralized funding. FAB has taken other steps to streamline its corporate services in the past year, as well: including a next-generation virtual account-management solution that includes payments centralization and advanced collection and FABePay, a self-service solution for making deposits.

FAB implemented a dynamic, revolving intraday limit, updated daily, on automatic processing of payments when an entity exceeds its proportion of balances held in a group treasury.

Money market funds (MMFs) perform a vital role in channeling liquidity into the economy during times of crisis by providing corporates a critical source of funding. Cairo-based Banque Misr, the Middle East’s Best Provider of Short-Term Investments/Money Market Funds, currently owns shares in 157 projects. It manages a diverse set of eight mutual funds with more than $1.43 million in assets and is the only bank in Egypt offering MMFs in US dollars and euros. Its Youm b Youm (Day by Day), with $1.37 million under management, is the leading MMF in the country.

The pandemic has increased the uptake of self-service banking solutions. Arab Bank, 2021’s Best Bank for Cash Management and our award winner for Outstanding Achievement in Treasury Operations During the Pandemic, sees its ArabiConnect cash management and trade finance platform as one such self-service solution. Clients can access all of their accounts and make wire transfers, international remittances, trade finance transactions, payroll transactions, foreign exchange and corporate bill payments via a single gateway. ArabiConnect also provides real-time and forecasted views of cash positions, facilitating critical liquidity decision-making. Another 2020 addition, ArabiSync, is a host-to-host solution between corporates and the bank.

Individual Middle Eastern countries and regional organizations are taking the Covid crisis as a signal to modernize payments systems. Jordan, Kuwait and the United Arab Emirates have launched, or are set to launch, modernization projects. Bahrain already offers instant payments, while Saudi Arabia is expected to launch its Instant Payments system later this year. Instant Payments is expected to bring speed and convenience to fund transfers while adding greater transparency, certainty and precision. Migration to the ISO 20022 messaging standard, meanwhile, promises enriched data, faster connectivity and integration, and a reduction in manual processes.

Still, the movement to rationalize payments systems preceded the pandemic. Many banks in the region are already live, or in the process of going live, with Swift gpi; in February 2020, the Arab Monetary Fund, which facilitates solutions to balance-of-payments issues between the Arab countries, launched the Buna payment platform, a payment platform that enables regional financial institutions to send and receive cross-border payments across the region and beyond.

Taken together, these developments promise to bring better liquidity management to businesses operating in the Middle East. As they gear up for a new, faster world of payments, they will look to banks in the region for support.