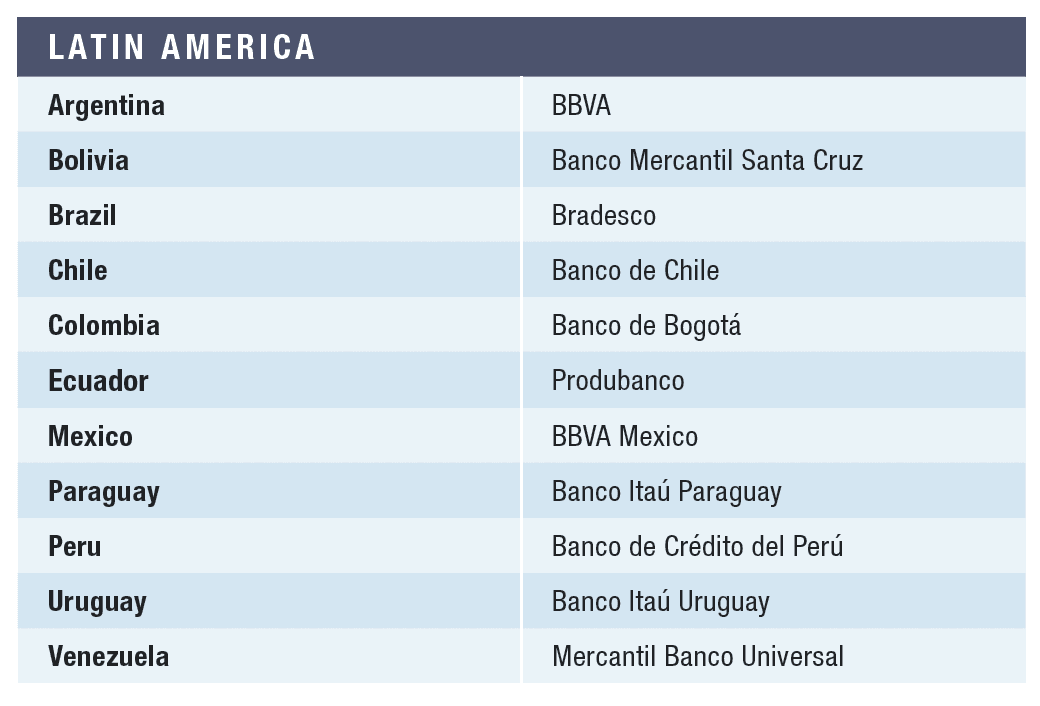

Better-than-average economic performance helped the region secure profitability and growth.

As central banks worldwide united to combat inflation by increasing interest rates, liquidity became scarce in most capital markets in 2022, abruptly ending the longstanding streak of profitability growth for many industries—banks included.

But while this trend affected the global economy, some regions proved more resilient than others. Such was the case for Latin America, further along than developed economies in its monetary tightening cycle and well positioned to benefit from higher commodity prices.

Despite the shocks stemming from Russia’s invasion of Ukraine and China’s lingering effects of zero-Covid policy, the region’s economy expanded by about 4% in the year, with strong employment growth and a service sector that rebounded from the pandemic-induced slump.

For Latin American banks, profitability also remained strong, albeit growing at a slower pace than in the previous year. Behemoth Brazilian banks kept leading the way for the region by expanding digital channels for businesses and individuals.

Delinquency rates grew due to higher interest rates, but profitability from higher loan margins widely made up for the losses. Looking into 2023, however, S&P Global expects the problem to deepen if the region’s central banks don’t start loosening their monetary policies soon.

In the investment spectrum, fixed income was the star of the year, a widely expected result of higher interest rates and lower foreign capital inflows. On the other hand, proceeds from equities and initial public offerings saw significant drops during the year—mostly in line with the global trend.

Regional Leader

Amid this challenging yet opportunity-rich environment, Bradesco seized the moment to cement its position as Global Finance’s Best Bank in Latin America for a second year.

The bank’s total assets climbed 8% to $338 billion, and shareholders’ equity reached $28 billion, resulting in a return on average equity (ROAE) of 13.1%.

Bradesco’s revenue from services grew 4.7% to $6.7 billion, with most of the growth driven by card income and custody and brokerage services. Income from insurance, pension plans and capitalization bonds also significantly increased by 28.9% to $2.8 billion. The Bradesco app also saw a 57% gain in individual and corporate financial transactions on mobile devices in 2022 compared to the previous year, indicating the bank’s successful digital transformation efforts.

The Brazilian giant also saw substantial growth in various financial indicators, including a remarkable 51% increase in net income compared to the previous year. The credit portfolio expanded by 38%, indicating a rise in lending activities. Total revenue grew by 29%, driven by increased income from various financial products and services. Deposits also increased significantly, with growth of 37%. Additionally, the bank witnessed an impressive 99% increase in assets under custody compared to the previous year.

Despite the challenging year, Bradesco did not stop making environmental, social and governance investments. As a result, the bank’s goal of directing $44.5 billion by 2025 to assets, sectors and activities with socio-environmental benefits took significant steps toward completion. By December 2022, the bank had already achieved about 69% of this goal, with $30.3 billion already allocated.

In its home country, Bradesco also continued to excel, mainly by investing in the digital realm, with digital channels accounting for a staggering 98% of transactions carried out at the bank. This represents a significant increase of 6% compared to the previous year, with 25.8 billion transactions carried out through digital means. For those achievements, Bradesco also takes Global Finance’s award as the best bank in its country.

Large Economies

As in Brazil, Mexico’s economy also proved relatively resilient in 2022. GDP growth surpassed market expectations for the year, and the country’s equity market comfortably outperformed the MSCI Emerging Markets Index benchmark.

In the banking spectrum, the market was shaken by Citi’s announcement early in the year that it was selling Citibanamex’s consumer, small-business and middle-market banking operations in the country after leading the market for many years.

This backdrop provided the perfect conditions for BBVA Mexico to keep gaining market share in the country, cementing its position as Global Finance’s Best Bank in Mexico for the third year in a row, with the leading market share in assets (21.9%), performing loans (24.4%), deposits (24%) and ATMs (23%).

Spanish-based BBVA reported a net interest income of $9.1 billion, representing a notable 30.8% year-over-year (YoY) gain with an impressive 25.8% return on equity (ROE).

BBVA’s secret to success comes mainly from the high level at which it focuses its investment on digital channels, leading sales through digital channels to increase from 69.8% in 2021 to 74.8% in 2022.

The bank also took the award for the Best Bank in Argentina, amid a much tougher environment of high inflation and hefty currency devaluation.

Despite a challenging economic environment, BBVA achieved a net income of $167 million in the first nine months of the year, representing a 28% increase compared to the same period in the previous year.

BBVA’s impressive operating income of $591 million, representing a 70% increase compared to the prior year, demonstrates the bank’s ability to effectively manage its operations and grow its business in a challenging market.

After a long decade of prosperity, the Chilean economy fared worse than the region’s average in 2022. However, despite the challenging outlook, Banco de Chile held its top position in the country for the seventh year in a row and ended the year ranked first in net income, net fees, net interest income and operating revenue.

The bank also achieved an impressive ROAE of 31.4%, with a net income of $433 million, representing a 20.8% YoY increase.

Colombia was an outlier toward the upside in Latin America in 2022. With impressive 7.5% GDP growth, much higher than the global average, the country produced many opportunities for those looking to grow their business. Banco de Bogota is our best bank in the country due to its ability to take advantage of the opportunity and produce impressive financial results.

The bank’s consolidated assets and its loan portfolio grew by 12% and 3.5%, respectively, reaching $29.2 billion and $20.1 billion. Banco de Bogota also achieved the highest return on assets in the Colombian market at 3.5% and the second-highest ROE at 22%, with a consolidated net income of $733 million. The spinoff of BAC Holding International in the year’s first quarter also helped Banco de Bogota’s performance.

Developing Economies

Banco Itaú Uruguay and Banco Itaú Paraguay take our award in those two countries, underscoring the Brazilian giant’s leadership in its neighboring economies.

In Uruguay, the bank took advantage of the global commodity boom and greater demand from China for food exports to increase its exposure to the sector via strategic partnerships for implementing its Visa Agro card targeting agricultural producers. Furthermore, Itaú Uruguay continued investing in the fintech sector, acquiring stakes in Uruguay-based Paigo, Prex and Resonance.

In Paraguay, the bank’s significant market presence and commitment to financial inclusion were the keys to its top-tier performance. Itaú’s total year’s revenue growth of 21% secured its position as one of the leading banks in Paraguay, with a market share of 25.5%.

Banco Mercantil Santa Cruz was the Best Bank in Bolivia due to its impressive financial performance and extensive nationwide network. In 2022, the bank had a net profit of $33 million and an ROE of 10.8%. Additionally, the bank has a market share of over 9%, significantly higher than its main competitors 5%.

In Peru, Banco de Credito del Peru (BCP) takes our award for the third year in a row, with a 2.3% return on assets and 21.1% ROE, indicating its ability to generate profits despite the country’s geopolitical turmoil. Additionally, BCP’s 30.1% in loans and 29.8% market share in deposits underscores its stable position as a leading player in the Peruvian banking sector.

The Venezuelan economy had recorded almost no growth for a decade; but it achieved 8% in 2022, with the banking sector taking advantage of the opportunity to produce impressive numbers. Such was the case of Mercantil Banco Universal, which saw its loan portfolio jump an astonishing 1,200% YoY, pushing the total managed assets up an astounding 395% from 2021. With those results, the bank was able to post a significant increase in its return on average assets and closed the year at 12.9%, while its ROAE rose to a solid 90%.