On a steep hill, China’s top banks blaze the right trail.

Over the past year, unprecedented economic challenges smay have reminded China’s bank executives of the old Chinese proverb “Doing what’s right is like climbing a hill.”

Indeed, the banking industry—and the entire financial sector in the world’s second-largest economy—has been on a precipitous climb that will continue well into 2023.

Yet, by doing the right things to maintain internal financial stability, serve a diverse customer base and support the nation, China’s best banks have shown their true mettle through challenging times and merit special honor as Global Finance’s Stars of China 2022.

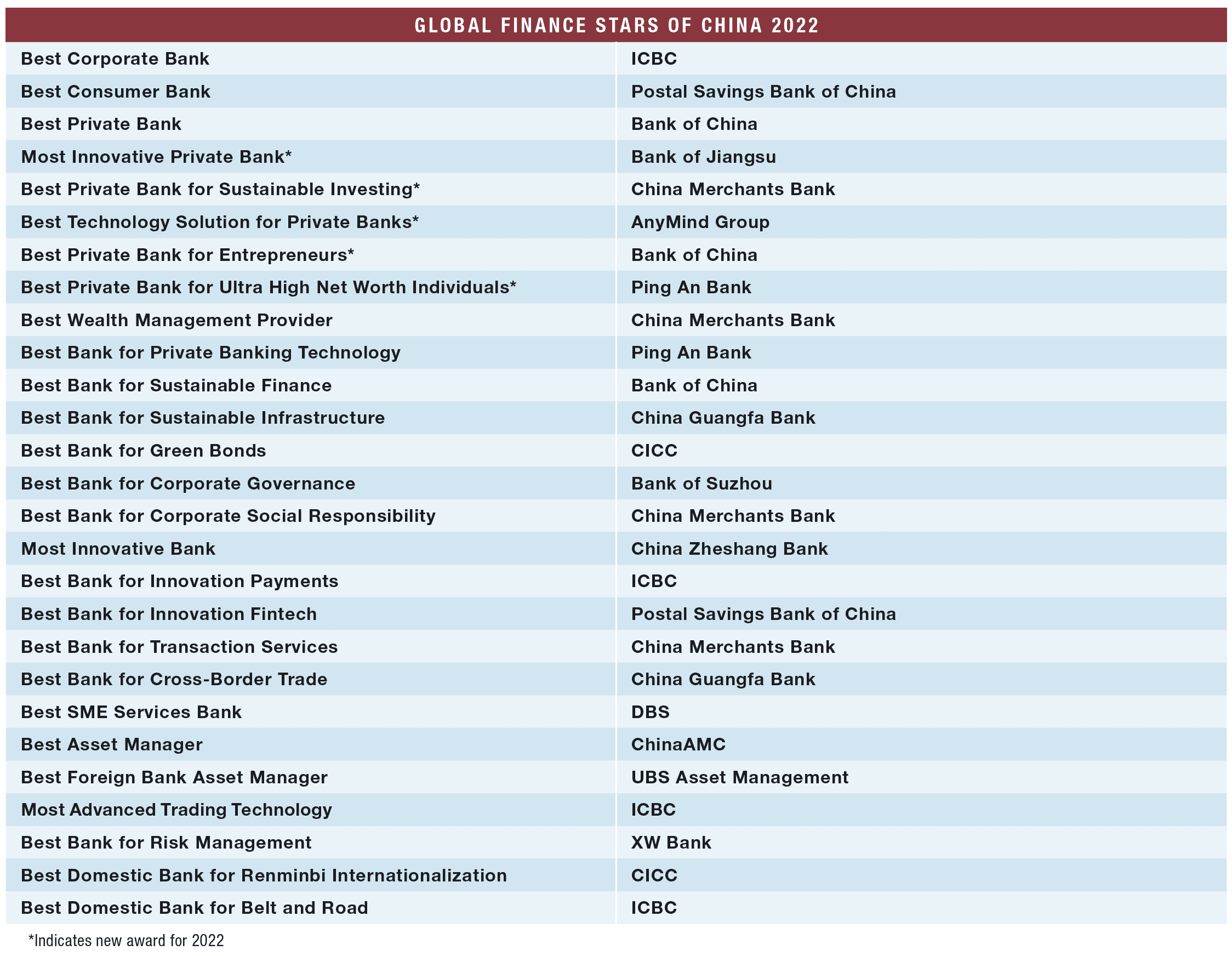

Now in its 15th year, Stars of China shines a spotlight on outstanding banks, asset managers and banking sector enterprises serving the vast mainland market. There are five new categories this year, bringing the number of awards to 27.

The world’s largest bank, Industrial and Commercial Bank of China (ICBC); and China Merchants Bank each won in four categories. The flagship Bank of China secured three trophies. China International Capital Corporation (CICC), Postal Savings Bank of China, China Guangfa Bank and Ping An Bank won two each.

Executives for the award winners say doing what’s right for the dynamic China market requires careful attention to the demands of diverse classes of clients, from small enterprises to ultrahigh net worth individuals. And it requires products for a galaxy of tasks, from green bonds to cross-border financing.

Raymond Yin, head of Asia-Pacific and of China Onshore for UBS Asset Management (UBS AM), attributes the firm’s success in the face of “fierce competition” to “a blend of our strong brand, diverse products and long track record.”

The award for Best Technology Solution for Private Banks went to AnyMind Group, whose co-founder and CEO Kosuke Sogo says his company over the years has “constantly innovated and scaled to provide our customers with incremental value. … At the moment, we’re actively supporting banking players in China for their marketing activities.”

Wang Ya, general manager of the Private Banking Centre, Personal Digital Banking at Bank of China (BOC), cites his bank’s new “Entrepreneur’s Office” service as an example of working “to integrate the resources of the BOC Group and leverage our service capabilities of globalized wealth management and integrated operation of commercial and investment banking to better serve the need for value management of entrepreneurs’ wealth.”

China needs strong banks, given that the nation’s GDP growth rate has slowed; and the yuan has weakened over the past year, impacting investment and credit demand. In August, government policy banks distributed 300 billion yuan (about $42 billion) for infrastructure projects as part of a 1 trillion yuan stimulus package. And Premier Li Keqiang encourages local governments to take full advantage of bond markets.

Through bond issues; wealth management; and investment criteria, banks play a significant role as China pursues big-picture goals such as sustainability, cyber technology development, poverty eradication and urban revitalization. Fintechs and mobile investing have graduated to the mainstream, cross-border transactions are lightning fast, the digital yuan is rising and the Belt and Road Initiative marches forward—all with significant thanks to banks.

“We define success not merely for enhancing profit growth but for maximizing the value of wealth from the perspective of our clients,” BOC’s Wang explains. “We advocate the concept of ESG and adhere to the path of green development while constantly contributing to social progress.”

The accomplishments of the Stars of China engender confidence in the banking sector’s financial strength and commitment to a growing economy.

“China’s economy has entered a stage of higher-quality development, including industrial upgrade and integration, technological innovation and sustainable development,” says UBS’ Yin. “The Chinese market can provide more alpha opportunities for investors.”

E-commerce is one of many areas for future growth, AnyMind’s Sogo says. “Consumers will need to make payments online to complete a purchase,” and “that will boost the Chinese banking sector.”

Another area is credit support and investing in emissions-reduction strategies, solar energy, electric vehicles and other green initiatives. China’s President Xi Jinping has pledged to fight climate change by working toward carbon neutrality, a benchmark that he has said will be achievable by 2060. China plans to peak its carbon emissions before 2030.

True, the current challenges can seem as daunting as a rocky footpath on a steep hill. But China’s banks and asset managers are committed to doing what’s right, with Stars of China award winners leading the way.

“We believe that in the next five to 10 years China’s asset management industry will usher in an unprecedented development period,” Yin says, and “unparalleled growth opportunities.”

Methodology: Behind the Rankings

Global Finance editors select the winners for the Stars of China using information provided in entries and independent research based on both objective and subjective factors. It is not necessary to enter in order to win, but an entry can provide details that may not be publicly available. The editors incorporate insights from executives, academics and other industry experts.

Judgements are based on performance from January 1 to December 31, 2021. We apply an algorithm to arrive at a numerical score on a 100-point scale. The algorithm incorporates criteria—including knowledge of local conditions and customers, financial strength and safety, strategic relationships, capital investment and innovation in products and services—weighted for relative importance.

Best Corporate Bank

Industrial and Commercial Bank of China (ICBC)

Challenging market conditions that impact corporate clients can test a bank’s ability to manage credit risk and protect earnings growth. So as challenges have mounted in recent years, many banks doubled down on risk management in their corporate business arena. A premier example of good practices in implementing this strategy is Industrial and Commercial Bank of China (ICBC), winner of the Best Corporate Bank award.

For ICBC, risk control does not mean skimping on loans. The current loan balance for corporate projects tied to China’s transportation and water networks, urbanization, clean energy and related needs exceeds 6 trillion yuan (about $833 billion). The balance for high-tech clients tops 1 trillion yuan, and so-called green lending exceeds 3 trillion yuan. ICBC’s hands-on approach to risk control includes training staff and strengthening links between its middle and back offices. The mechanism focuses on heightening staff responsibility, monitoring and evaluating client risks in various industries and forming risk mitigation proposals. As a result, ICBC’s corporate loan asset quality has improved: Despite a challenging economic climate, the bank’s balance of nonperforming corporate loans has declined.

As of June, interest income from corporate loans reached a record 220 billion yuan, for a loan balance of 11.7 trillion yuan and a corporate deposit balance of 6 trillion yuan. As a corporate banker, ICBC is controlling risk and making money

Best Consumer Bank

Postal Savings Bank of China (PSB)

Teaching consumers the basics of money management, personal investing and fraud protection is often the work of a financial adviser or perhaps the author of a self-help book. Can a bank provide valuable instruction by converting branch meeting rooms into learning centers? Postal Savings Bank answered “Yes” and now offers financial education programs at many of its 40,000 retail outlets nationwide, proving itself the right choice for the Best Consumer Bank award.

Sponsoring financial literacy classes for the public is a win-win for the bank and its 637 million individual customers as it builds knowledge in the community and customer loyalty. Moreover, the strategy keeps brick-and-mortar outlets alive in the era of online banking, which Postal Savings has fully embraced.

The bank deserves credit for various other creative projects in the consumer sphere, such as promoting walk-in retail services and business districts in neighborhoods with its outlets. Postal Savings says its “enduring commitment to retail banking” has been a boon to the bottom line, with income from personal banking business last year rising nearly 12%, compared to 2020, to about 222 billion yuan—accounting for about 70% of operating income. As a consumer-education bank, Postal Savings is at the head of the class.

Best Private Bank

Bank of China

A lot has changed since the first domestic, private banking services were launched in China at the end of 2014. What began as a niche business focused on client wealth-building has expanded to encompass support for family trusts, childhood education, charitable giving, global investing and more. At the forefront of these changes is the Bank of China (BOC), this year’s choice for the Best Private Bank honors.

BOC pioneered private banking with a first-of-its-kind service in 2014. Today, the private bank counts more than 150,000 clients and manages 2.3 trillion yuan, a treasure chest that’s risen tenfold in 15 years.

The bank’s first charitable trust for national causes was launched in 2017, several years after it started coordinating client support for children’s charities. More recently, asset management products that earn income and support charities and social causes, such as rural area revitalization, have been rolled out. During the year ended last March, more than 200 family trusts were established with combined assets of about 5 billion yuan, bringing total family trust assets to more than 12 billion yuan. The variety of services speaks to BOC’s flexibility—and progress—in the private banking arena.

Most Innovative Private Bank — New

Bank of Jiangsu

Customer relations are like lubricating oil if wealth management is the engine of a private bank’s business. Both are crucial for catering to high-net-worth individuals and entrepreneurs. The Bank of Jiangsu is strong on the wealth side and exceptional in applying innovation in client relations, thus earning Stars of China’s first-ever Most Innovative Private Bank award.

The bank uses big data and live videoconferencing to manage and personalize customer relations. On the management side, digital-activity tracking and client-behavior analysis allow for precision marketing and banking operations. Each investment portfolio contributes to a client’s “customer portrait,” thus making diversified services rather than product sales the bank’s focus. One innovative result is a private Family Harmony service package that integrates family trust, insurance fund trust, charitable trust and discretionary entrusted asset services.

Bank of Jiangsu distinguishes itself as a regional bank designed to serve the people of Jiangsu Province. But its private bank division doesn’t think provincially: Jiangsu is a major global manufacturing hub. The private bank serves about 20,000 high net worth business owners and local individuals enrolled in an enterprise investment scheme. The scheme is just one way the Bank of Jiangsu embraces innovation to enhance the customer experience.

Best Private Bank for Sustainable Investing — New

China Merchants Bank

Investing for the future is a course pursued by a growing percentage of private bank account holders. They include individuals and families working to support investment targets that meet environmental, social and governance (ESG) standards. An increasing number of these investors are turning to China Merchants Bank (CMB), winner of the Stars of China’s first-ever Best Private Bank for Sustainable Investing award.

Between 2020 and 2021, CMB reported a 22% jump in private bank clients to a record 122,000. Combined assets under management for these clients also rose 22% to nearly 3.4 trillion yuan. It’s no coincidence that this growth followed the bank’s stepped-up role in ESG investing. For example, CMB has assigned a Strategy and Sustainable Development Committee under its board of directors to promote ESG-related activities. Last year, the stock indexer MSCI upgraded the ESG rating for CMB’s stock from BBB to A, the highest among similar banks listed on the Shanghai exchange.

Sustainable, ESG-related investing is only one dimension of CMB’s private bank business. Family trusts, charity support and private placement services for equities traders are also popular. CMB plans to continue following a sustainable investing path to attract future-oriented private bank clients.

Best Technology Solution for Private Banks — New

Anymind Group

The private bank arena is a magnet for services developed by tech companies that tap the two-way potential of personal electronic devices. Through these services, banks can electronically market and deliver financial products. Private bank clients, meanwhile, get convenient access to accounts, advisers and investments. A leading facilitator of these win-win services is AnyMind Group, selected for the first-ever Best Technology Solution for Private Banks award.

Launched in Singapore in 2016, AnyMind started in the marketing-tech industry with online advertising and influencer marketing for clients across Asia. Since then, its diverse suite has expanded into e-commerce and conversational commerce. Private banks depend on the company’s AnyChat service for real-time, interactive video chats with clients. One bank successfully used the influencer-marketing platform AnyTag to promote an app and credit card. Through AnyTag, the bank used social media and videos featuring four shopping-focused opinion leaders to draw 1.2 million views and 95,000 clicks for the credit card offer.

Since the pandemic began, Chinese regulators have encouraged banks to broaden the use of electronic delivery systems. Private banks have been at the forefront of this trend and AnyMind is a tech company they rely on.

Best Private Bank for Entrepreneurs — New

Bank of China

Business is never the only responsibility shouldered by China’s most successful entrepreneurs. No matter how wealthy and devoted to work, most top-tier entrepreneurs look after families, charities and public causes. So they appreciate a private banker that understands these various roles and provides flexible, multilevel support for financial security. More than ever, entrepreneurs appreciate the Bank of China, winner of the first-ever Stars of China award for Best Private Bank for Entrepreneurs.

Unique services under its Entrepreneur’s Office umbrella set BOC apart in private banking. Brand customers receive special access to the bank’s myriad offerings, from securities to aircraft leasing, funds to insurance, and wealth planning to enterprise operations. In January 2022, the bank sponsored a summit to recognize and encourage business innovation among its entrepreneur clients. The bank has fostered a sharing community by supporting summits focusing on inheritance for first-generation entrepreneurs and their families, encouraging attendees to cultivate friendships among themselves. Hundreds of company founders have been surveyed to craft relevant wealth planning. Similarly, BOC takes the initiative to encourage charitable giving.

Entrepreneurs are dynamic citizens at the forefront of China’s economic growth. BOC understands this and accepts a big responsibility by fulfilling its clients’ private banking needs.

Best Private Bank for Ultra High-Net Worth Individuals

Ping An Bank

Thinking out of the box is a must for private banks catering to China’s preeminent clientele. Creative solutions in investment management, inheritance planning and personal services are crucial to attracting and keeping ultrahigh net worth individuals. Ping An Bank grasps this truth and has responded with a range of unique solutions, thus earning the award as the Best Private Bank for Ultrahigh Net Worth Individuals.

For example, the bank offers clients an investment advisory service that includes access to the main office and branch strategists. Ping An has enhanced inheritance services by reducing from a month to a few days the time needed to establish an insurance trust. In response to a strong interest in charitable giving, Ping An launched the industry’s first one-stop charity-planning service in 2021. Worldwide healthcare resources, tax advice and educational support for elite customers’ children are also available.

Ping An’s approach to ultrahigh net worth banking works well for all, as creative solutions provide both a substantial revenue stream and satisfied clients. Now, the bank is getting well-deserved recognition for these accomplishments.

Best Wealth Management Provider

China Merchants Bank

China’s wealth management providers are broadening their horizons to serve a clientele beyond the traditional class of well-heeled investors. Perhaps the most prominent leader in this outreach is China Merchants Bank, which offers products tied to several other banks through an app platform. In 2021, CMB posted a 35% year-on-year increase in its wealth management product balance to more than 3 trillion yuan. On that basis, CMB was a clear choice for Best Wealth Management Provider.

In addition to attracting more middle-income customers, CMB’s wealth management ecosystem is winning over younger investors. People younger than 35 composed about 52% of the 9.5 million customers who used the CMB app for wealth management transactions last year. Industry players also rely on the app: 87 leading asset management firms have joined the platform. Factoring in all wealth product sources, CMB’s retail assets under management grew 20% between 2020 and last year to more than 10 trillion yuan.

Innovative app-based services such as the artificially intelligent wealth assistant called Xiao Zhao and the enterprise-focused Xin Fu Tong helped the bank post a 30% jump in wealth management clients last year to 37 million. Indeed, CMB is reaching higher in the wealth management sector.

Best Private Bank for Private Banking Technology

Ping An Bank

Access can be empowering for a private banking client equipped with an intuitive, easy-to-use financial services app. Scrolling through investment market performance data and position analyses can offer a satisfying sense of control. The Ping An Bank app provides that access with industry-leading functions, underscoring Ping An’s honors as Best Bank for Private Banking Technology.

The bank’s app includes a private placement platform—a first in China—that gives clients anywhere-anytime investment capabilities. An intelligent carry-on feature automatically matches customer demands with business services, including investment advisers. It steers users to advisory services with an expert staff ready to provide one-on-one support. The app has been key to pandemic-period growth for Ping An’s private banking business, paving the way for deeper wealth management investment by more clients.

Private banks used to rely on customers who demanded in-person, red-carpet treatment at branch outlets. Ping An Bank found that technology trumps red carpets among modern-day, investment-oriented private bank customers.

Best Bank for Sustainable Finance

Bank of China

Banking support for a cleaner world requires backing some projects and abandoning others. Financing a wind-power project is no problem, but rainforest logging is another story. Bank of China embraced this approach as an environmentally aware financier well deserving of the Best Bank for Sustainable Finance award.

BOC says it’s stopped crediting enterprises blacklisted for poor ESG performance records. Since late 2021, the bank has generally ceased financing new coal mining and coal-fired power projects outside China while imposing stringent management and control measures on existing projects. BOC has also imposed measures to stop funding customers tied to illegal logging or the poaching of wild animals.

The bank has pledged no less than 1 trillion yuan in support of green industries between 2021 and 2025. As of June, the green credit balance of the bank’s domestic institutions topped 1.7 trillion yuan. Efforts were underway to boost the annual growth rate of green consumer loans to 60% from the current 30%. Meanwhile, BOC is cutting credit to “brown” industries on behalf of sustainable finance goals.

Best Bank for Sustainable Infrastructure

China Guangfa Bank

Finding that sweet spot between financing the real economy and sustainability projects can be challenging for a bank in China, where the search process must also factor in earnings targets and regulatory responsibilities. The real economy needs jobs; but a sustainable energy project, for example, can affect coal miners. So China Guangfa Bank’s ability to find that sweet spot is no small feat, highlighting its selection as Best Bank for Sustainable Infrastructure.

Guangfa has shown its commitment to China’s national carbon neutrality and green development goals by financing investments such as a 17 billion yuan solar cell production project unveiled in early 2022 and by introducing consumer credit cards tied to low-carbon investments. Real-economy support focuses on sustainable investment in the Greater Bay Area of Guangdong Province. And in China’s northeast, the bank arranged pandemic-support loans for a rice processing company and a livestock feed collective. Guangfa Vice President Fang Qi recently described the nation’s carbon neutrality goals as a chance for financiers to refocus support for energy, transportation, construction and manufacturing. The bank is doing that and more for sustainable infrastructure.

Best Bank for Green Bonds

CICC

A burst of activity in the green bond market since 2021 reflects strong institutional support for a clean-green economic plan promoted by the Chinese government. A leading supporter is the investment bank China International Capital Corporation (CICC), the nation’s number-one underwriter-manager of green corporate bonds and winner of the Best Bank for Green Bonds award for the second year in a row.

CICC’s leadership includes its work in cooperation with the China Development Bank as lead underwriter for green bonds issued in 2021 on behalf of ecological protection and green economic development along the length of the Yangtze River from Chengdu to Shanghai. CICC helped attract a variety of institutional investors and deepened international support for regional green finance in China. CICC also recently underwrote the market’s first carbon neutrality and rural revitalization double-label corporate bond for a solar power firm. And the bank helped a wind-power provider issue China’s first carbon neutrality real estate investment trust listed on the Shanghai Stock Exchange.

Last year, green bond issuance nationwide topped 607 billion yuan—up 168% from the year before, with funds targeting public utilities, local government development projects and the transportation industry. CICC is playing a major role in this movement for a greener future.

Best Bank for Corporate Governance

Bank of Suzhou

Monitoring a Chinese bank’s business practices and the bottom line is usually the responsibility of a front office that answers to a board of directors. But some banks have solidified the monitoring process with board-appointed committees charged with specific watchdog tasks. The Bank of Suzhou leads the pack: the first in China to establish a financial integrity and ethics management committee at the board level. As a result, it’s the winner of this year’s Best Bank for Corporate Governance honors.

The city commercial bank has set a high bar for integrity and safe business practices through the board’s committee and a management-level committee for employee oversight. Bank of Suzhou’s stated intent is to “promote the organic integration of [Communist] party leadership and corporate governance” while building a modern financial institution. The result has been positive for earnings: The bank reported its net profit rose 17% year-on-year to nearly 2.5 billion yuan in 2021. Bank of Suzhou is proof that profits flow from sound corporate governance.

Best Bank for Corporate Social Responsibility

China Merchants Bank

The UN-supported group Principles for Responsible Investment (PRI), touted as the world’s leading proponent of responsible investment, has commended governments in China for taking significant steps toward reducing pollution and improving energy efficiency in Chinese firms. The next step, PRI says, is to get more companies on board the environmental bandwagon. China Merchants Bank fully responds to this call with an ESG focus, securing this year’s Best Bank for Corporate Social Responsibility award.

CMB’s subsidiary China Merchants Fund is a PRI signatory that, as of 2021, held five ESG products with a combined value more than twice that of the previous year, reaching over 1.4 billion yuan. One product focuses on solar energy investments, while another is battery themed. The bank’s wealth management plans are deeply involved in ESG products; and as a bond underwriter, CMB supports 38 types of green bonds worth more than 61 billion yuan. Most of these bonds target energy¬ and emissions-cutting projects at home and abroad.

Perhaps most importantly, CMB credit officers are keen on green lending. Companies and projects are scrutinized for environmental impact before loans are approved. The strategy has succeeded, with the bank’s current green loan balance topping 263 billion yuan, up more than 26% in one year. CMB is adhering to its PRI pledge with green results.

Most Innovative Bank

China Zheshang Bank

The banking industry’s ongoing shift to online accounts, apps and cloud services has been driven by customer demand and the profit motive. Balancing these motivations is vital for any bank playing to win the virtual-business innovation game. China Zheshang Bank (CZBank) has struck that balance, winning this year’s Most Innovative Bank honors.

Customers come first, through its “digital intelligence” system, marketed under the Digital Intelligence (DI) CZBank brand. The system tailors services according to each customer’s needs, whether an investment account, cross-border financing, retail support or something else. DI Supervision, for example, applies digital technology to credit-risk control for small and midsize enterprises (SMEs). Using big data, the bank serves enterprises by marrying blockchain and supply chain services. CZBank acknowledges digitization’s labor and time-saving benefits while improving its bottom line. The bank reported a 2.75% profit increase last year, from 2020, to 12.6 billion yuan, as well as assets of nearly 2.3 trillion yuan.

The bank also applies the Internet of Things to risk control and uses big data to process microloan applications quickly. CZBank has struck a balance as a digital banking innovator.

Best Bank for Innovation in Payments

ICBC

The growing need to protect bank customers from bad actors has paralleled the rise of online payment systems. So, the best banks are familiar with the dangers and are consistently taking the initiative to improve system safeguards. ICBC knows how to thwart bad actors while excelling in online customer service, earning the Best Bank for Innovation in Payments award.

Through its ICBC Express remittance platform, the bank has integrated financial technology and business operations using an application programming interface, artificial intelligence and robotic process automation. Cross-border payments for individuals and enterprises are fast and safe. A security-related compliance review that usually takes up to three days can be processed in minutes through ICBC Express ,with end-to-end tracking and foreign currency services. The world’s first-of-its-kind stop-and-recall feature prevents telecom fraud. Safety initiatives also mark ICBC’s pandemic response, which includes support to protect customers and staff.

ICBC Express has proliferated since its launch in 2014 to serve domestic and overseas clients, including enterprises linked to China’s Belt and Road effort and Chinese students studying abroad. As a result, remittances are sailing through cyberspace efficiently and securely.

Best Bank for Innovation in Fintech

Postal Savings Bank of China

In China, the banking sector’s testing phase for financial technology (fintech) products and processes is quickly fading. Now that fintech has matured, banks invest deeply to grow apps and related services. Postal Savings Bank of China is setting the industry pace in fintech investment, earning its award as this year’s Best Bank for Innovation in Fintech.

Although fintech innovation can be expensive, Postal Savings has chosen not to skimp. The bank invested about 27 billion yuan, more than 3% of its operating income, on IT-related projects over the past three years. Last year alone, Postal Savings implemented 389 IT projects. It’s also been on a hiring spree focusing on young, techie talent.

As a result, the bank’s customers are benefiting from streamlined loan approvals online, digital yuan access and mobile payments. More than 326 million customers currently do business through the bank’s app, as transactions in 2021 rose 16.8% from the previous year and online loans jumped more than 50%. Postal Savings is investing in a fintech future, with positive results.

Best Bank for Transaction Services

China Merchants Bank

Streamlining cash management, supply chain financing and asset custody for enterprises is one way a bank builds a strong reputation for transaction services. When transactions move seamlessly, time is saved so it can be better spent. China Merchants Bank has earned a good name for time-saving techniques, which explains its healthy client growth and its selection as Best Bank for Transaction Services.

One growth area is a “cloud direct linkage” system connecting CMB to enterprise clients for electronically signing invoices, bills and other documents. As of late 2021, linkage users had climbed nearly 34% year on year to 107,400. Innovative collection and payment products have cut time for transaction handling by 10% and batch transactions by 7%. CMB also plans to rollout its CBS8 cross-bank fund management platform during the third quarter, which would put collections, payments, electronic guarantees, invoicing and more under one roof.

CMB’s success aligns with its recent decision to broaden business with more settlements, engagements and high-quality customers. The result is a reputation second to none for transaction banking.

Best Bank for Cross-Border Trade

China Guangfa Bank

Global trade’s complexities have been mounting ever since the pandemic disrupted supply chains and closed borders for weeks at a time. Yet savvy banks managed the challenges of cross-border shipping by fine-tuning online transactions and foreign exchange services. China Guangfa Bank specializes in this area by employing its Cross-Border Instantaneous Program, a key reason why Guangfa was chosen as Best Bank for Cross-Border Trade.

Many of Guangfa’s customers were well prepared for the issues that emerged in early 2020, because the bank’s cross-border system was already three years old. Transactions through the system are entirely paperless. Trade financing and customs processing have been vastly streamlined, with processes that used to take days being completed in minutes. Guangfa also facilitates cross-border trade with a blockchain platform through which data is shared with foreign exchange, customs agents and tax offices.

Customers in international trade areas such as Guangdong Province and Hong Kong have especially benefited from Guangfa’s expertise. The program’s client base has thus proliferated, reaching 6,100 customers as of June. Cross-border shipping is still a challenge, but Guangfa makes it work.

Best SME Bank

DBS

What do the Beijing-based healthcare app provider KingYee Group and garment manufacturer Shanghai Fashion Tech have in common? Both are growing enterprises with significant export businesses requiring foreign exchange and cross-border trade support. And both have relied on the international business expertise of DBS, this year’s Best SME Services Bank.

DBS has been serving small and midsize enterprises (SMEs) for decades, first in Singapore and since 1993 in China, when it became one of the first foreign banks to provide financial services to SMEs on the mainland. The bank helps SMEs improve supply chain efficiency by, for example, financing procurement as well as sales. DBS’ experience with two-way, mainland-Hong Kong transactions is a vital point, allowing Greater Bay clients to maintain DBS Hong Kong and DBS China multicurrency accounts.

KingYee tapped DBS for help navigating a successful initial public offering on the Hong Kong Stock Exchange, opening a one-stop service for overseas accounts and swapping currencies with the DBS Ideal account management app. Shanghai Fashion benefited from the bank’s experience with the timely handling of payments from overseas customers. These are just two of the many growing enterprises that appreciate partnering with DBS.

Best Asset Manager

ChinaAMC

Leadership in the investment industry requires beating competitors at the earnings game and shaping the game—for example, by building a playing field for increasingly vital ESG investing. As China’s first asset manager to form a companywide ESG committee led by a CEO, ChinaAMC has contributed significantly to this increasingly vital investment arena. This leading role in ESG and related initiatives helped ChinaAMC win this year’s Best Asset Manager honors.

In 2021, the firm became the first of its kind in China to announce a specific investment road map for carbon neutrality. ChinaAMC developed a six-step ESG integration process for its clients to achieve that goal, blending sustainable investment objectives, fundamental analysis, and portfolio and risk management. The firm also actively engages companies: Since 2018, ChinaAMC has had dozens of engagements with mainland-listed companies seeking to enhance their ESG disclosures, spelling out risks to sustainable development and even training management.

The effort has paid off. ChinaAMC launched six ESG funds in the year ending March 31, 2022, including a “low-carbon economy” ETF that’s soared to the best in China with $645 million under management.

ChinaAMC serves 191 million retail and 89,000 institutional investors, managing about $260 billion. The firm not only leads but earns.

Best Foreign Bank Asset Manager

UBS Asset Management

Patience is a virtue and a necessity for any foreign bank with an asset management business in China. China’s opening of financial markets since the launch of the Qualified Foreign Institutional Investor (QFII) scheme 20 years ago has been gradual. Zurich-based UBS was the first overseas firm to win a QFII license, laying the groundwork for a winning streak that now includes this year’s award for its China affiliate UBS Asset Management (UBS AM) as Best Foreign Bank Asset Manager.

UBS was the first foreign financial institution to hold a maximum 49% stake in a Chinese mutual fund company; and in 2017, it became the first Qualified Domestic Limited Partnership license-holder to receive a private fund management license. Today, the Shanghai-based asset manager serves clients with equity and fixed-income teams entrenched in the mainland’s $20 trillion asset management market. UBS AM pursues alpha opportunities and customizes multiasset allocation products to serve inbound and outbound investors.

As doors continue to open, China’s investment market is becoming more international and institutional. By exercising patience while moving forward, UBS AM is well positioned to benefit from this trend.

Most Advanced Trading Technology

ICBC

Just a glimpse of the digital system for global payments and clearing known as ICBC Global Pay can be as head-spinning as a graduate course in cyber technology. The system utilizes data lakes, intelligent character recognition, robotic process automation and other digital components beyond a layman’s grasp. But no extra head space is needed for ICBC customers who use Global Pay to seamlessly manage accounts, collections, payments, liquidity, short-term financing, investments and risk. This technological genius combined with ease of use explains ICBC’s selection as the bank with the Most Advanced Trading Technology.

Connected to the Swift system and serving more than 10,000 customers worldwide—mainly multinational enterprises—the clearing system features treasury management and unified standards for handling Chinese and foreign currencies. Links to overseas clearing systems allow transactions through 6,000 banks in more than 140 countries and regions. Standout services include real-time remittance tracking, global payroll processing and paperless account opening in most currencies, for corporate clients.

ICBC says Global Pay is guided by the bank’s commitment to digitally supporting cross-border trading and global economic growth with an “international vision” for every time zone worldwide. It’s a big commitment with complex components serving a satisfied clientele.

Best Bank for Risk Management

XW Bank

An online bank needs cybersecurity protection as much as a bank’s brick-and-mortar outlet needs a vault. So China’s handful of online banks is locked into protecting the virtual environments critical for their systems and clients. The online provider XW Bank, recognized as this year’s Best Bank for Risk Management, is notably successful in the safety arena.

Chengdu-based XW Bank is a financial affiliate of smartphone giant Xiaomi, sharing the virtual-only market with Alibaba-affiliated MYBank and Tencent’s WeBank. Due to their unique business focus rooted in technology, all three banks have cybersecurity in their blood. At a recent conference, XW Vice President Xu Zhihua described his bank’s digital risk management as based on a complete intelligent service system with developers, analysts and data scientists managing an intensive data operations platform. XW works with the bank card provider UnionPay’s data arm through a “real-time, multiheaded” sharing platform. The system was built in response to a People’s Bank of China fintech innovation project launched in 2020.

Xu says that the bank approves and automatically issues 99% of all loans through the platform. Strong cybersecurity risk controls helped the bank record a nonperforming loan rate of only 1.04% in the first half of 2021, down 0.15% from the previous half despite a 2.3 billion yuan increase in assets. Banking in cyberspace is a low-risk process for XW Bank.

Best Bank for Renminbi Internationalization

CICC

Banks are leading China’s effort to expand commercial and investor use of the national currency—the yuan, or renminbi (RMB). A key driver of this ongoing initiative centers on global bond markets, with RMB-denominated “panda bonds” sold on the mainland and “dim sum bonds” issued in Hong Kong. The investment bank CICC is at the forefront of this critical bond activity, thus earning the award for Best Domestic Bank for Renminbi Internationalization.

In 2021, CICC worked with the municipality of Shenzhen on a dim sum bond issuance considered significant for the two-way opening of the Chinese local government market because it set a benchmark for similar bonds in the future. That same year, CICC, for a fourth time, helped spearhead an RMB-denominated panda bond issuance for New Development Bank—formed by the BRICS nations (Brazil, Russia, India, China and South Africa) to support infrastructure projects in their countries. CICC also helped Credit Agricole Bank issue panda bonds last year.

Bond investors have responded well to these and other recent RMB-denominated issues, indicating the growing acceptance of China’s currency. The response also underscores CICC’s award-winning leadership for internationalization of the RMB.

Best Domestic Bank for Belt and Road

ICBC

Strength and overseas experience are key ingredients for a bank that wants to support a large-scale energy project in a faraway land. Even more is needed when that energy project requires end-to-end financial advisory services for every industrial chain link.

ICBC has repeatedly excelled in supporting large-scale, multilevel development projects attached to China’s celebrated overseas infrastructure and trade initiative. With good reason, ICBC has been named this year’s Best Domestic Bank for Belt and Road.

Every bank supporting Belt and Road is committed to projecting China’s global trade and infrastructure development goals. ICBC’s noteworthy difference is its ability to provide financial services for major oil, gas and mineral projects overseas for which Chinese enterprises have taken leading roles. Several such projects have required support for integrated resource development, receiving terminals, pipeline storage and transportation. In the infrastructure sector, the bank has promoted upgrading China-foreign project investment cooperation. It’s also working on green financing to support China’s goals of capping carbon dioxide emissions and achieving carbon neutrality.

The Belt and Road project will turn a decade old in 2023. So it’s fitting at this time that ICBC—a bank long dedicated to supporting the initiative’s multifaceted projects—receives this special recognition.