Could Bahamians be pioneers of a new world economy?

When the Bahamas got hit by hurricane Dorian in 2019, a string of islands named Abaco, on the north of the country-archipelago, got especially battered before the storm moved on to strike the better-known island of Grand Bahama to the east. Hundreds lost power and communications for days and almost 13,000 families lost their homes. Total damage was assessed at about US$3.4 billion, or more than 25% of the country’s annual pre-pandemic GDP of US$13.579 billion per International Monetary Fund (IMF) figures.

People were desperate for help, yet government aid trickled out slowly, and people couldn’t get cash or rely on the physical or electronic banking infrastructure. This led to several looting events, especially in the Abaco chain, as well as a major flow of displaced people to the capital city of Nassau, which was largely spared.

The trauma caused by Dorian is often touted by officials from the Central Bank of the Bahamas as one of the biggest advantages to the country’s pioneer launch of the world’s first officially issued and central bank-backed digital currency (a CBDC)–the Sand Dollar. Beyond serving as a means of digitally storing money directly at central banks and using it anywhere, digital currencies and wallets need not rely on Internet connections for payment transfers, which can be authenticated on-device via token technology, making it very convenient as a payment and storage method even when banks are not accessible—as in the days and weeks after Dorian in Abaco and the Grand Bahama.

The Sand dollar is for all intents and purposes Bahamian dollars by a different name only. The program launched in October 2020 but is only now starting to be implemented in earnest, with several commercial banking systems and payment providers connecting to mobile Sand Dollar wallets, and a renewed push to enroll individuals on the various platforms.

Because it is an extension of the country’s fiat currency, the Sand dollar carries the same guarantees as the regular Bahamian dollar, which is pegged at a one-to-one ratio to the US dollar. “A CBDC is as trustworthy as the regular currency issued by the specific central bank backing it,” says Henri Arslanian, Global Crypto Leader and Partner at PwC. “What is special about CBDC is that it is central bank money. CBDC is de facto equivalent to a bank note, but in digital format. For the first time in our generation, we are seeing the emergence of a new form of central bank money,” he explains.

While the launch of the first CBDC is headline-grabbing, the move doesn’t come without some controversy. A high-ranking Western diplomat based on the islands and following the implementation of the Sand Dollar, who was not authorized to speak to the press, tells of local bankers wary of the lax enforcement of ID requirements to open digital Sand Dollar wallets. “There is a growing perception that because ID enforcement is lax, the digital currency could, with time, become a possible tax evasion mechanism for individuals who open wallets under forged IDs. Another preoccupation is related to how acquisition of Sand Dollars may become a path to Bahamian fiscal domicile, and, again, a path to home-country tax evasion,” says the diplomat.

Tomer Ravid, crypto entrepreneur and CEO at BloxTax, a cryptocurrency tax and anti-money laundering (AML) platform and auditing firm, is skeptical of that. “Blockchain technology is very, very safe, and works based on consensus. Everything is transparent, some would argue too transparent. If I know your wallet, I can see every transaction and amount you have. By design, CBDCs will be permission-based blockchains, which means the central bank has even more control of what is happening,” he says.

For now, the Bahamas has two levels of enrolment available to individuals: tier one users are not required to present any form of ID or link a bank account to open their Sand Dollar digital wallet, but they are only allowed to hold up to $500 at any given time in their e-wallet and are limited to a monthly transaction volume of $1,500. Tier two users are required to produce a government-issued ID and can link a bank account to their wallets. In exchange for the added layer of scrutiny, they can hold up to $8,000 in e-money with a monthly transaction limit of $10,000.

According to the diplomat, there is mounting evidence that the government ID requirement often means showing a regular utility bill in the country without any further checks to see if the user is the person named therein.

“Even if that is the case,” says Ravid, “the amount you can hold as an individual is so low and available only domestically and in local currency that it hardly seems to be relevant in terms of trans-national illegal activities at this point, especially given the amount of Bahamian dollars in circulation.”.

Arslanian concurs. “If you are a criminal, you are much better off using old-fashioned cash,” he says. “Even with cryptocurrencies like Bitcoin, it is still possible to trace and track movements across the blockchain over a time frame if you know what you are looking for.”

PwC’s Global CBDC Index report from April 2021 puts the Central Bank of the Bahamas and the Sand Dollar at the number one spot in the maturity of their CBDC-project development. According to the study, the islands lead the rank by a margin of more than 10% over the second most mature project—in Cambodia—with 92 points versus 83 points on a scale that peaks at 100.

However advanced the Sand Dollar, both Arslanian and Ravid caution that the Bahamas is too small an economy and in a peculiar geographical situation to serve as a major model for the implementation of other CBDCs.

“The impact of the Sand Dollar is very limited, which doesn’t mean it’s irrelevant,” says Ravid. According to both crypto specialists the player to watch for is China. “China may not have launched officially yet, but they’ve been experimenting and planning the e-renminbi since 2014 […] They have already piloted the project with millions of users, and its sheer scale may change the landscape for CBDC,” Arslanian says.

“China has been quietly working on this for years and they have done everything right. They understand the power of having their own currency as a cheap alternative to other reserve currencies, and a digital currency could allow them to expand the use of the yuan internationally in a much simpler, cheaper, and faster way than moving cash or relying on international clearing houses,” Ravid argues.

There may be other motives connected to the launch of CBDCs: more precise control of the economy and economic planning.

“CBDCs will be huge. Picture the amount of economic planning it’ll give to central bankers. Suddenly you’ll be able to know exactly how much people are spending on things like coffee. More than that, depending on the implementation, you could know which type of coffee people are buying. That will allow governments to plan their economy in really specific terms,” says Ravid.

“CBDCs will give new tools for governments to manage the economy. In a situation like Covid-19, with a slumping economy, for example, you could disburse stimulus money that has a use by date. Either you spend that money helping quick start the economy, or it disappears from your digital wallet. You can even program the money to be usable on only certain types of goods or merchants,” Arslanian explains.

“As everything else, the new tools made available by the introduction of CBDCs could also be twisted to further tighten the grip of non-democratic and oppressive regimes over their populations,” the Bahamas-based diplomat points out, “however, the level of detail and control [introduced by CBDCs] could truly be a boon for central-bankers and other economy-planning stakeholders.”

E-money also has an enormous disruption potential: transactions are carried out directly at the central bank level and can bypass retail banks for simple everyday transactions.

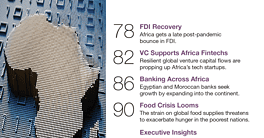

Ravid believes we are witnessing the early days of a new world in economics. “The Bahamas is very, very small, but it’s the first project to launch. It’s almost like a guinea pig for the rest of the world. And everybody is watching.”